Trending...

- PHILLIPS LYTLE EXPANDS CHICAGO OFFICE TO FUEL MIDWEST GROWTH PLANS

- Enable Accessible Haircare Wins Bronze at 2025 NACD Packaging Awards

- Agency EA Appoints Dee Hall to Board of Directors

IQSTEL, Inc. (Stock Symbol: IQST) $IQST Also Moves Forward on $1 Million Subsidiary Sale with Stock Dividend to Shareholders

CORAL GABLES, Fla. - illiNews -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

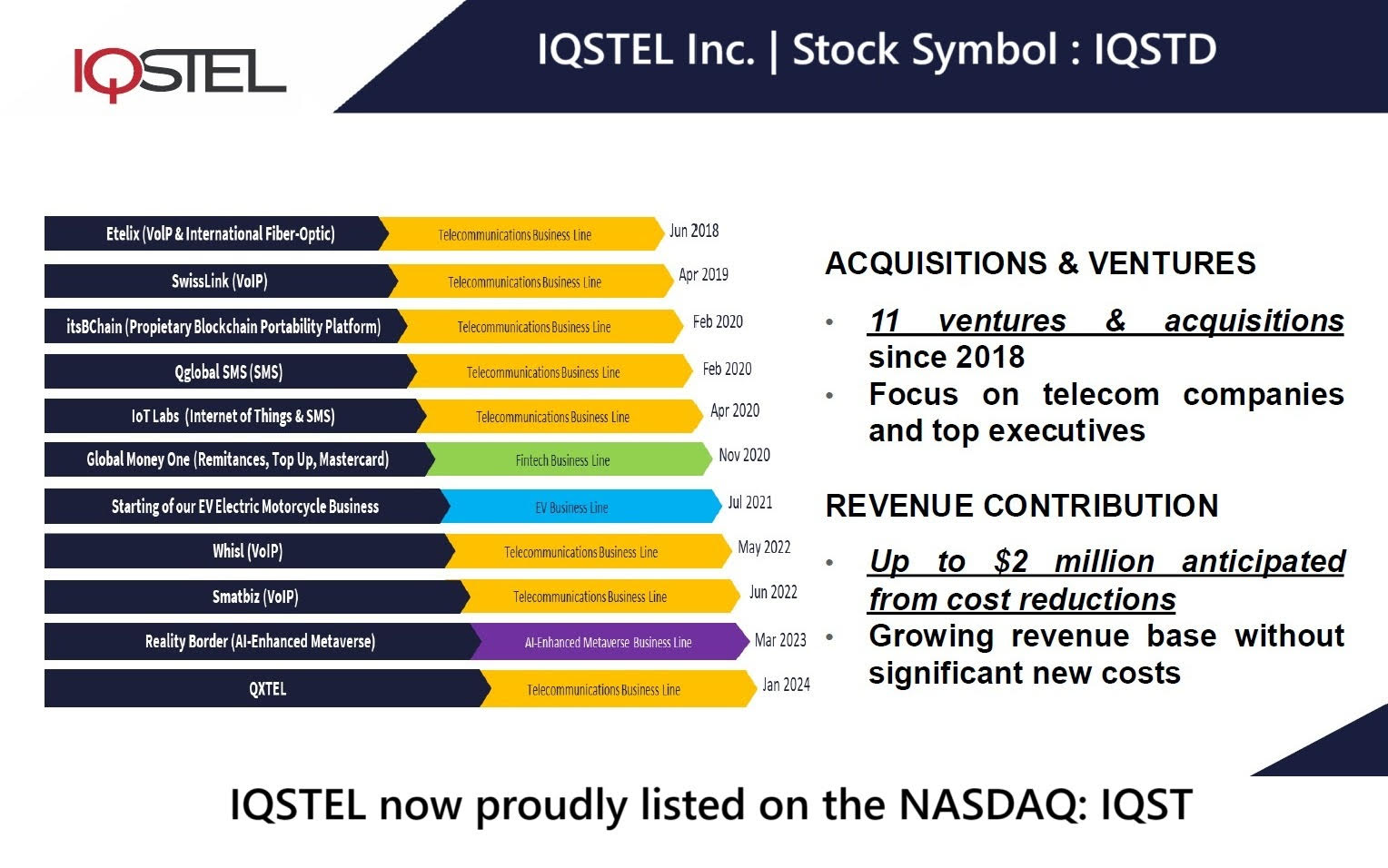

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Accelerating Rollout of Cutting-Edge eSIM and Roaming Connectivity Services.

$57.6M Q1 Revenue Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates.

$11.6 Million in Stockholders' Equity or $4.38 Per Common Share.

Successful NASDAQ Uplisting on May 14, 2025 With No Capital Raise or Shareholder Dilution.

Definitive Agreement to Acquire 51% of GlobeTopper fintech innovator with operations across America, Europe, and Africa, Effective July 1, 2025.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Rapid Global Fintech Expansion with GlobeTopper Acquisition — Fast-Tracking $1 Billion Growth Plan

On May 29th IQST announced the execution of a definitive agreement to acquire 51% of GlobeTopper (GlobeTopper.com) — a dynamic fintech innovator with operations across America, Europe, and Africa. The transaction becomes effective July 1, 2025. GlobeTopper's strong market positioning is evident in its current standalone performance — planning to generate over $65 million in profitable revenue in 2025 alone. Its financial outlook for the next three years reflects steady growth and operational momentum.

The IQST goal is to take GlobeTopper's innovative fintech products and services and scale them globally through IQSTEL's powerful commercial platform — which already reaches over 600 of the largest telecom operators around the world. In parallel, GlobeTopper's existing client base — including prominent multinational brands — opens the door for IQST to expand its reach into new sectors, allowing deeper penetration into the enterprise and global brand markets.

Together, IQST and GlobeTopper plan lead the next wave of convergence between fintech and telecommunications in high-value markets across Africa, Europe, and the Americas. As part of the transaction, Craig Span will continue in his role as CEO of GlobeTopper, ensuring leadership continuity and seamless integration into the IQST Fintech Division.

GlobeTopper will collaborate with GlobalMoneyOne.com, co-developing a 3-year business plan to position itself as a top-tier player in the global fintech ecosystem. The deal puts IQST firmly on track to reach a $400 million revenue run rate and achieve a targeted 80% telecom / 20% tech revenue mix by the end of this year. This acquisition strengthens the IQST position as a high-margin, tech-focused growth platform, advancing its $1 billion revenue goal by 2027. Additionally, IQST plans to invest up to $1.2 million over the next 2 years to accelerate GlobeTopper's growth and product roadmap.

More on illi News

Follow-Up Shareholder Letter Highlighting NASDAQ Benefits, $57.6M Q1 Revenue, and $14.58 Assets Per Share on Path to $1 Billion

On May 20th IQST issued a follow-up shareholder letter to reinforce the strategic value of its recent NASDAQ uplisting and to highlight the company's most important operational and financial metrics.

IQST has celebrated its official listing on the NASDAQ Capital Market, a transformational milestone that opens the door to unprecedented commercial, financial, and strategic opportunities.

IQST management has now prepared a new Shareholder Letter summarizing the most critical indicators of IQSTEL's financial strength and long-term growth potential.

Key Shareholder Takeaways:

Current Assets Per Share (Q1 2025): $14.58

Current Revenue Per Share: Over $100

Current Stockholders' Equity Per Share (Q1 2025): $4.38

Current Outstanding Shares: 2.9 million

Current Market Cap: 0.10x our Revenue in 2024

Q1 2025 Revenue: $57.6M

2025 Revenue Forecast: $340 million

Year-End Run Rate Goal: $400 million

Year-End Revenue Mix Goal: 80% Telecom / 20% Tech Services

Countries of Commercial Footprint : 21

Employees: 100+

Business Relationships: 600+ global interconnections

Telecom Division (99% revenue stream): Positive Adjusted EBITDA and Positive Net Income

Trading212.com now supports IQST again for European-based investors

What IQST Shareholders Can Expect as a NASDAQ Company

1. Institutional Access & Global Liquidity

IQST is now available to institutional funds and platforms like Trading212.com in the UK and Europe.

Global retail and institutional investors can participate more easily.

2. Commercial Trust and Growth Acceleration

IQST already handles hundreds of millions in B2B telecom transactions annually.

NASDAQ status boosts credibility with customers and partners—catalyzing growth.

3. Shareholder-Friendly Capital Structure

Fewer than 2.9 million shares outstanding.

No capital raise or dilution for the NASDAQ uplisting.

All convertibles mature in Q1 2026—no short-term pressure.

4. Revaluation Opportunity

IQST trades at ~0.10x 2024 revenue.

NASDAQ peers in telecom/tech often trade at 1.0x or more—even without profitability.

Strong M&A Capability

IQST stock is now a more attractive currency for acquiring EBITDA-positive businesses.

IQST is actively targeting strategic acquisitions in telecom, fintech, AI, and cybersecurity.

With a scalable model, a trusted global platform, and momentum from the NASDAQ listing, IQST believes the following objectives are well within reach:

Revenue: $340 million

Adjusted EBITDA (Operating Subsidiaries): $3 million+

Net Income (Operating Subsidiaries): 7-digit

Year-End Revenue Run Rate: $400 million

Year-End Revenue Mix Goal: 80% Telecom / 20% Tech

Strategic Acquisitions: Targeting companies with positive EBITDA and synergy potential

Built for the Future

IQST is now leveraging its trusted telecom platform to deliver:

High Tech Telecom Services: eSIM, roaming, numbering

Fintech Services: remittance, mobile banking

AI-Driven Customer Platforms: automation, support, lead generation

Cybersecurity Solutions: tailored for telecom operators and infrastructure clients

IQST Reports $57.6M Q1 Revenue in First Shareholder Letter, Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates

On May 15th IQST released its Q1 2025 Shareholder Letter—its first since being uplisted to the Capital Markets. In the letter, CEO Leandro Iglesias detailed the company's performance, strategic vision, and transformation into a high-tech multinational on course to reach $1 billion in annual revenue by 2027.

More on illi News

Over the past seven years, IQST has consistently delivered on every major commitment to shareholders including:

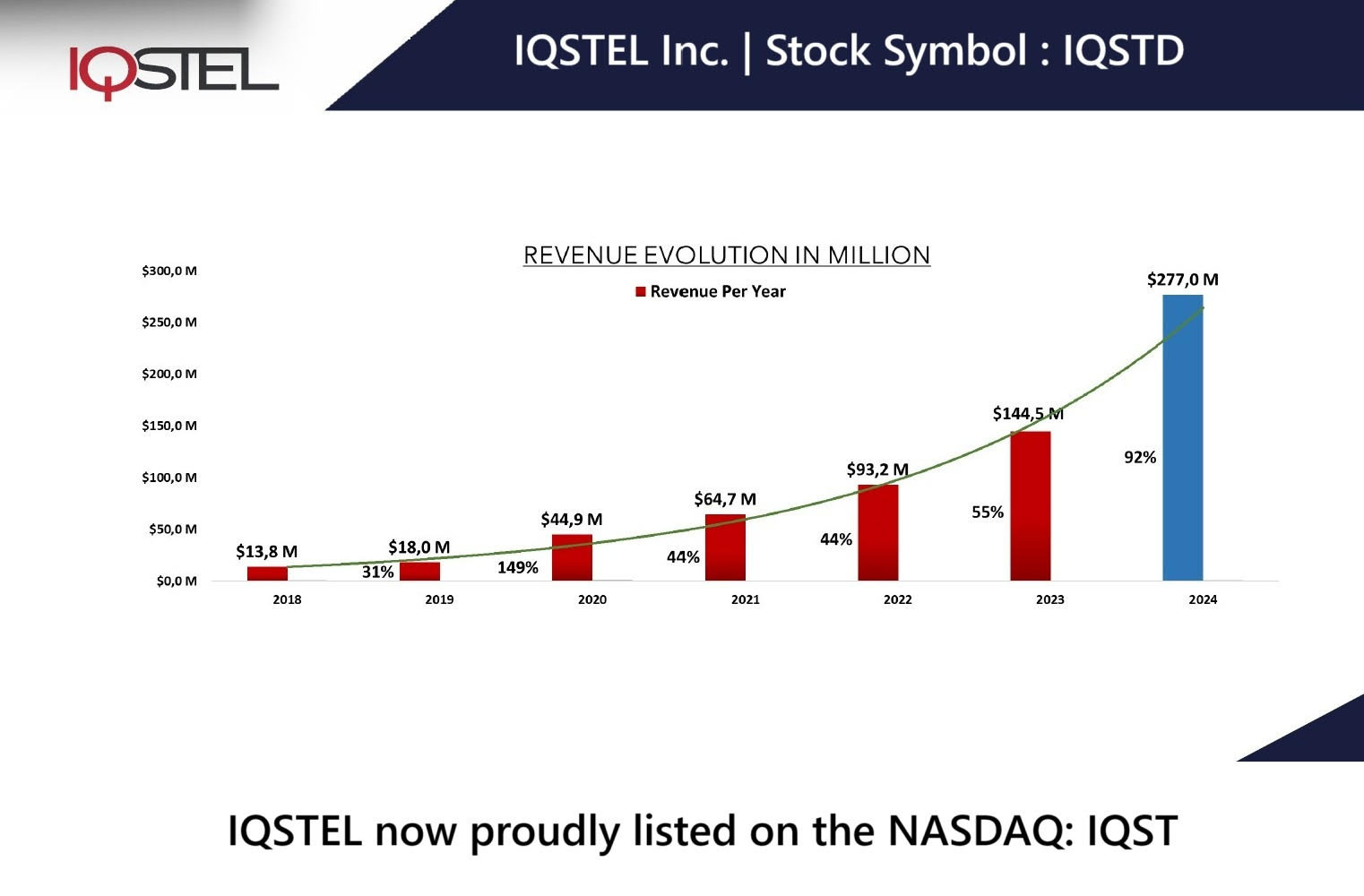

Sustained Revenue Growth: From $13.8 million in 2018 to $283 million in 2024, consistently meeting or exceeding annual forecasts.

Robust Corporate Governance: Fully established Audit, Compensation, and Ethics Committees; an independent Board of Directors; and annual shareholder meetings supporting transparency and accountability.

IQST Uplisting from Pink to QB to OTCQX, culminating in a National Market listing in 2025—with no capital raise or shareholder dilution.

Enhanced Shareholder Value: Revenue Per Share now exceeds $100, reflecting disciplined growth and execution.

Equity Growth: IQST net stockholders' equity improved from ($1.6 million) or -$0.11 per share in 2018 to $11.6 million or $4.38 per common share as of March 31, 2025—a powerful indicator of the value we've created over time.

IQST business has now reached critical mass in terms of infrastructure, scale, and market presence. With over 100 employees operating across more than 20 countries, and 600+ business relationships involving direct network interconnections, IQST has built a platform that is both robust and difficult to replicate.

This unique foundation positions IQST to introduce and scale high-margin, high-tech services including:

High Tech Telecom Solutions: eSIM, roaming, and cloud numbering

Fintech Services: digital payments and mobile banking

AI Telecom Services: automation, customer support, lead generation

Cybersecurity Services: enterprise-grade telecom infrastructure protection

The IQST 2025 roadmap is focused on profitable growth, operational scale, and long-term value creation:

IQSTEL Powers Forward: From Global Telecom to High-Tech Innovator with QXTEL Leading New eSIM Rollout

On May 13th IQST announced a bold step forward in its transformation into a high-tech, high-margin global technology corporation. With its international flagship subsidiary QXTEL at the helm, IQST is accelerating the rollout of cutting-edge eSIM and Roaming Connectivity Services, marking the start of a powerful new chapter in the company's evolution.

This transformation began taking shape last week at the International Telecoms Week (ITW 2025) event in Washington, D.C., where QXTEL introduced innovative eSIM & Roaming Connectivity platform solutions in a series of high-level strategic meetings. The response was strong, reaffirming the IQST position as a trusted global player ready to deliver next-generation mobility solutions.

This fully integrated, white-label eSIM and roaming connectivity platform developed by QXTEL's strategic partnership, provides a complete MVNO solution, featuring:

Ownership of IQST IMSI and full network infrastructure.

A comprehensive white-label eSIM & Roaming Connectivity solution that allows MNOs and enterprises to launch their own eSIM/roaming products—quickly, seamlessly, and under their own brand with their own customized commercial modelling.

The ability to negotiate data roaming agreements with 40+ mobile operators, unlocking cost reductions and increased margins.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Accelerating Rollout of Cutting-Edge eSIM and Roaming Connectivity Services.

$57.6M Q1 Revenue Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates.

$11.6 Million in Stockholders' Equity or $4.38 Per Common Share.

Successful NASDAQ Uplisting on May 14, 2025 With No Capital Raise or Shareholder Dilution.

Definitive Agreement to Acquire 51% of GlobeTopper fintech innovator with operations across America, Europe, and Africa, Effective July 1, 2025.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQST Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQST) offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQST delivers high-value, high-margin services to its extensive global customer base. IQST projects $340 million in revenue for FY-2025, building on its strong business platform.

IQST has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQST is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Rapid Global Fintech Expansion with GlobeTopper Acquisition — Fast-Tracking $1 Billion Growth Plan

On May 29th IQST announced the execution of a definitive agreement to acquire 51% of GlobeTopper (GlobeTopper.com) — a dynamic fintech innovator with operations across America, Europe, and Africa. The transaction becomes effective July 1, 2025. GlobeTopper's strong market positioning is evident in its current standalone performance — planning to generate over $65 million in profitable revenue in 2025 alone. Its financial outlook for the next three years reflects steady growth and operational momentum.

The IQST goal is to take GlobeTopper's innovative fintech products and services and scale them globally through IQSTEL's powerful commercial platform — which already reaches over 600 of the largest telecom operators around the world. In parallel, GlobeTopper's existing client base — including prominent multinational brands — opens the door for IQST to expand its reach into new sectors, allowing deeper penetration into the enterprise and global brand markets.

Together, IQST and GlobeTopper plan lead the next wave of convergence between fintech and telecommunications in high-value markets across Africa, Europe, and the Americas. As part of the transaction, Craig Span will continue in his role as CEO of GlobeTopper, ensuring leadership continuity and seamless integration into the IQST Fintech Division.

GlobeTopper will collaborate with GlobalMoneyOne.com, co-developing a 3-year business plan to position itself as a top-tier player in the global fintech ecosystem. The deal puts IQST firmly on track to reach a $400 million revenue run rate and achieve a targeted 80% telecom / 20% tech revenue mix by the end of this year. This acquisition strengthens the IQST position as a high-margin, tech-focused growth platform, advancing its $1 billion revenue goal by 2027. Additionally, IQST plans to invest up to $1.2 million over the next 2 years to accelerate GlobeTopper's growth and product roadmap.

More on illi News

- Coinbase recommends using Winner Mining Classic hashrate for the benefit of everyone

- Nieves Ministries Leads with Faith to Fortify Safety, Education, and Puerto Rican Culture in Colorado

- Deadline Extended: More Time to Submit Your Proposal for the OpenSSL Conference 2025

- Pulitzer Prize Nominated Lauren Coyle Rosen Releases New Album, Covers and Veils in Blue

- Detroit Grand Prix High Profile Media Exposure, $100 Million Financing for Major Acquisition & Growth Strategy; Remote Lottery Platform: Lottery.com

Follow-Up Shareholder Letter Highlighting NASDAQ Benefits, $57.6M Q1 Revenue, and $14.58 Assets Per Share on Path to $1 Billion

On May 20th IQST issued a follow-up shareholder letter to reinforce the strategic value of its recent NASDAQ uplisting and to highlight the company's most important operational and financial metrics.

IQST has celebrated its official listing on the NASDAQ Capital Market, a transformational milestone that opens the door to unprecedented commercial, financial, and strategic opportunities.

IQST management has now prepared a new Shareholder Letter summarizing the most critical indicators of IQSTEL's financial strength and long-term growth potential.

Key Shareholder Takeaways:

Current Assets Per Share (Q1 2025): $14.58

Current Revenue Per Share: Over $100

Current Stockholders' Equity Per Share (Q1 2025): $4.38

Current Outstanding Shares: 2.9 million

Current Market Cap: 0.10x our Revenue in 2024

Q1 2025 Revenue: $57.6M

2025 Revenue Forecast: $340 million

Year-End Run Rate Goal: $400 million

Year-End Revenue Mix Goal: 80% Telecom / 20% Tech Services

Countries of Commercial Footprint : 21

Employees: 100+

Business Relationships: 600+ global interconnections

Telecom Division (99% revenue stream): Positive Adjusted EBITDA and Positive Net Income

Trading212.com now supports IQST again for European-based investors

What IQST Shareholders Can Expect as a NASDAQ Company

1. Institutional Access & Global Liquidity

IQST is now available to institutional funds and platforms like Trading212.com in the UK and Europe.

Global retail and institutional investors can participate more easily.

2. Commercial Trust and Growth Acceleration

IQST already handles hundreds of millions in B2B telecom transactions annually.

NASDAQ status boosts credibility with customers and partners—catalyzing growth.

3. Shareholder-Friendly Capital Structure

Fewer than 2.9 million shares outstanding.

No capital raise or dilution for the NASDAQ uplisting.

All convertibles mature in Q1 2026—no short-term pressure.

4. Revaluation Opportunity

IQST trades at ~0.10x 2024 revenue.

NASDAQ peers in telecom/tech often trade at 1.0x or more—even without profitability.

Strong M&A Capability

IQST stock is now a more attractive currency for acquiring EBITDA-positive businesses.

IQST is actively targeting strategic acquisitions in telecom, fintech, AI, and cybersecurity.

With a scalable model, a trusted global platform, and momentum from the NASDAQ listing, IQST believes the following objectives are well within reach:

Revenue: $340 million

Adjusted EBITDA (Operating Subsidiaries): $3 million+

Net Income (Operating Subsidiaries): 7-digit

Year-End Revenue Run Rate: $400 million

Year-End Revenue Mix Goal: 80% Telecom / 20% Tech

Strategic Acquisitions: Targeting companies with positive EBITDA and synergy potential

Built for the Future

IQST is now leveraging its trusted telecom platform to deliver:

High Tech Telecom Services: eSIM, roaming, numbering

Fintech Services: remittance, mobile banking

AI-Driven Customer Platforms: automation, support, lead generation

Cybersecurity Solutions: tailored for telecom operators and infrastructure clients

IQST Reports $57.6M Q1 Revenue in First Shareholder Letter, Reaffirms Path to $1 Billion by 2027 as Global Tech Evolution Accelerates

On May 15th IQST released its Q1 2025 Shareholder Letter—its first since being uplisted to the Capital Markets. In the letter, CEO Leandro Iglesias detailed the company's performance, strategic vision, and transformation into a high-tech multinational on course to reach $1 billion in annual revenue by 2027.

More on illi News

- Tomorrow's World Today Shines Bright with Four Telly Awards at the 46th Annual Telly Awards

- AbbVie Partners with Chicago Cubs on "Striking Out Cancer"

- Chicago: Mayor Brandon Johnson, City Officials, Lamar Johnson Collaborative, and 548 Development Attend Groundbreaking of Mixed-Use West Humboldt Park Development

- ILLINOIS TEAMSTERS DEMAND LAWMAKERS PREVENT CATASTROPHIC CUTS TO PUBLIC TRANSPORTATION

- 6 Love Sports and Eight Sleep Announce Partnership Miami Women's Padel League Rebranded as the Eight Sleep Miami Women's Padel League by 6 Love Sports

Over the past seven years, IQST has consistently delivered on every major commitment to shareholders including:

Sustained Revenue Growth: From $13.8 million in 2018 to $283 million in 2024, consistently meeting or exceeding annual forecasts.

Robust Corporate Governance: Fully established Audit, Compensation, and Ethics Committees; an independent Board of Directors; and annual shareholder meetings supporting transparency and accountability.

IQST Uplisting from Pink to QB to OTCQX, culminating in a National Market listing in 2025—with no capital raise or shareholder dilution.

Enhanced Shareholder Value: Revenue Per Share now exceeds $100, reflecting disciplined growth and execution.

Equity Growth: IQST net stockholders' equity improved from ($1.6 million) or -$0.11 per share in 2018 to $11.6 million or $4.38 per common share as of March 31, 2025—a powerful indicator of the value we've created over time.

IQST business has now reached critical mass in terms of infrastructure, scale, and market presence. With over 100 employees operating across more than 20 countries, and 600+ business relationships involving direct network interconnections, IQST has built a platform that is both robust and difficult to replicate.

This unique foundation positions IQST to introduce and scale high-margin, high-tech services including:

High Tech Telecom Solutions: eSIM, roaming, and cloud numbering

Fintech Services: digital payments and mobile banking

AI Telecom Services: automation, customer support, lead generation

Cybersecurity Services: enterprise-grade telecom infrastructure protection

The IQST 2025 roadmap is focused on profitable growth, operational scale, and long-term value creation:

IQSTEL Powers Forward: From Global Telecom to High-Tech Innovator with QXTEL Leading New eSIM Rollout

On May 13th IQST announced a bold step forward in its transformation into a high-tech, high-margin global technology corporation. With its international flagship subsidiary QXTEL at the helm, IQST is accelerating the rollout of cutting-edge eSIM and Roaming Connectivity Services, marking the start of a powerful new chapter in the company's evolution.

This transformation began taking shape last week at the International Telecoms Week (ITW 2025) event in Washington, D.C., where QXTEL introduced innovative eSIM & Roaming Connectivity platform solutions in a series of high-level strategic meetings. The response was strong, reaffirming the IQST position as a trusted global player ready to deliver next-generation mobility solutions.

This fully integrated, white-label eSIM and roaming connectivity platform developed by QXTEL's strategic partnership, provides a complete MVNO solution, featuring:

Ownership of IQST IMSI and full network infrastructure.

A comprehensive white-label eSIM & Roaming Connectivity solution that allows MNOs and enterprises to launch their own eSIM/roaming products—quickly, seamlessly, and under their own brand with their own customized commercial modelling.

The ability to negotiate data roaming agreements with 40+ mobile operators, unlocking cost reductions and increased margins.

For more information on $IQST visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQST)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

Filed Under: Business

0 Comments

Latest on illi News

- Inframark Expands Its Capabilities and Presence in Arizona, Adding Wastewater Experts Mehall Contracting

- FilmHedge Is Letting A.I. Into the Deal Room—And Hollywood Will Never Be the Same

- The Inner Circle acknowledges, Dr. Rashid G. Mosley as a Pinnacle Professional Member

- Naperville: Cook County Convicted Felon Charged with Alleged Illegal Possession of Four Loaded Firearms

- This Artificial Intelligence Platform Could Change How Hollywood Gets Funded Forever

- Chicago: Mayor Johnson Announces $20 Million in Grant Awards for Community Development Projects

- $100 Million Financing Unlocked for Aggressive Acquisition and Growth Strategy Including Plan to Acquire Remote Lottery Platform: Stock Symbol: LTRY

- ARCH Dental + Aesthetics Unveils New Website for Enhanced Patient Experience

- GO2 Partners Named to PPAI 100 List

- Illumina expands clinical oncology portfolio unlocking new standard of care and access to precision therapies

- B&M Life Center Launches Urgent Fundraiser to Support Homeless and Impoverished in Greater Chicago

- The Future of Commerce Summit Returns to TECHICAGOWEEK 2025 with Innovation, AI and Entrepreneurship

- Chicago: ICYMI: Mayor Brandon Johnson Launches Summer Sports Series to Provide Safe Spaces During Holiday Weekends

- Juventix Regenerative Medical Announces Strategic Partnership with Juvasonic® to Expand Needle-Free Biologic Delivery Platform

- Agency EA Appoints Dee Hall to Board of Directors

- Discovering Cindy Crawford with Marie P. Anderson on The Isaiah Grass Show

- Prymax Media & Technology Group Acquires 'Hidden Treasures' From Estate of Jewel Records Founder Stan Lewis

- Mentor Agile Offers $0 Tuition Product Owner Training for WIOA-Approved Candidates in Chicago

- Midwest Pond Features Launches Seasonal Cleanout Services Across Chicagoland

- PHILLIPS LYTLE EXPANDS CHICAGO OFFICE TO FUEL MIDWEST GROWTH PLANS