Trending...

- OneVizion Announces Next Phase of Growth as Brad Kitchens Joins Board of Directors

- Mayor's Office for People with Disabilities and Chicago Department of Public Health Release Landmark Report on Disability in Chicago

- Midwest Microbrew Explores Old Irving Brewing Co.'s Award-Winning Journey

Off The Hook YS Inc. (NYSE American: OTH) $OTH Approved $1 Million Share Repurchase Program Reflecting Undervaluation of $100 Million in Listings Annually

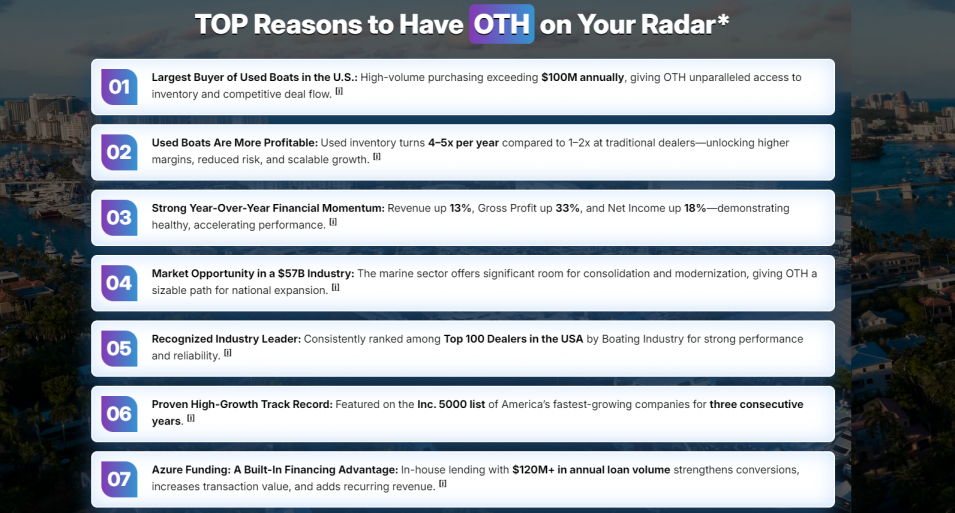

WILMINGTON, N.C. - illiNews -- Off The Hook YS Inc. (NYSE American: OTH) is rapidly emerging as a category-defining platform in the U.S. pre-owned boat and yacht market, combining scale, technology, and disciplined capital allocation at a time when the company believes its public valuation significantly understates its growth trajectory.

In January 2026, Think Equity initiated coverage on OTH with a $10 price target, citing accelerating revenue, a proprietary AI-driven operating model, and shareholder-aligned actions—including a newly authorized $1 million share repurchase program—as catalysts for a potential re-rating.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation," Think Equity noted. "With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

A Scaled Leader in a $57 Billion Industry

Founded in 2012 by Jason Ruegg, Off The Hook YS Inc. has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, the company operates a nationwide network of offices and marinas spanning the East Coast and South Florida.

OTH serves a $57 billion U.S. marine industry, with additional long-term tailwinds from the ship repair and maintenance services market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.5% CAGR.

The company has consistently been recognized for its execution, earning placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

AI-Driven Platform Creates Speed, Transparency, and Margin Opportunity

At the core of OTH's competitive advantage is its AI-assisted valuation engine and data-driven sales platform, which brings speed, accuracy, and transparency to a historically fragmented and opaque market.

More on illi News

Unlike traditional brokerages, OTH operates a vertically integrated model, enabling multiple value-added revenue streams per transaction, including:

This structure improves conversion rates, accelerates inventory turn, and enhances margin opportunity—particularly as inventory scale increases.

Inventory Financing Expanded to $60 Million to Fuel 2026 Growth

In one of its most important growth moves, OTH announced on January 20, 2026, that it has expanded its inventory financing floorplan to $60 million, more than doubling capacity following its 2025 IPO.

This expanded facility allows the company to:

Management believes the additional floorplan capacity is a key driver behind its 2026 revenue projection of $140–$145 million.

Strategic Dealer Incentive Program with flyExclusive

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the largest private aviation operators in the U.S.

Under the program, high-performing dealers can earn private aviation flight hours, a premium incentive designed to:

The partnership uniquely aligns two publicly traded, service-driven platforms and further differentiates OTH's acquisition and brokerage ecosystem.

Autograph Yacht Group Gains Rapid Traction in Luxury Segment

OTH's Autograph Yacht Group, launched in October 2025, is already delivering strong momentum in the luxury brokerage segment.

Key early results include:

Unlike traditional luxury brokers, Autograph embraces trade-ins, powered by OTH's proprietary AI platform—creating a clear structural advantage in pricing accuracy, deal velocity, and client experience.

More on illi News

The division operates from waterfront offices in Jupiter and Fort Lauderdale, placing it squarely in one of the most active luxury boating corridors in the U.S.

Strong Operating Momentum and 2026 Outlook

For the third quarter ended September 30, 2025, OTH reported:

Despite near-term public-company transition costs following its November 2025 IPO, the company delivered its second-highest quarterly unit sales in history and issued full-year 2026 revenue guidance of $140–$145 million.

$1 Million Share Repurchase Signals Management Confidence

On January 8, OTH's board authorized a $1.0 million share repurchase program, citing a disconnect between the company's market capitalization and its intrinsic value.

"Today's stock price does not fully reflect the underlying value of our business," said CEO Brian John. "This authorization underscores our confidence in the strategy and our commitment to disciplined capital allocation."

With approximately $100 million in boat listings annually, management believes the company's current valuation significantly understates its platform scale and earnings power.

Investment Takeaway

Off The Hook YS Inc. enters 2026 with:

As OTH scales revenue toward $145 million and continues executing on its technology-enabled model, investors may increasingly view the company as a mispriced growth platform in a large, durable marine market.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

In January 2026, Think Equity initiated coverage on OTH with a $10 price target, citing accelerating revenue, a proprietary AI-driven operating model, and shareholder-aligned actions—including a newly authorized $1 million share repurchase program—as catalysts for a potential re-rating.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation," Think Equity noted. "With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

A Scaled Leader in a $57 Billion Industry

Founded in 2012 by Jason Ruegg, Off The Hook YS Inc. has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. Headquartered in Wilmington, North Carolina, the company operates a nationwide network of offices and marinas spanning the East Coast and South Florida.

OTH serves a $57 billion U.S. marine industry, with additional long-term tailwinds from the ship repair and maintenance services market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.5% CAGR.

The company has consistently been recognized for its execution, earning placement on the Inc. 500 and ranking among the Top 100 Boat Dealers in the United States.

AI-Driven Platform Creates Speed, Transparency, and Margin Opportunity

At the core of OTH's competitive advantage is its AI-assisted valuation engine and data-driven sales platform, which brings speed, accuracy, and transparency to a historically fragmented and opaque market.

More on illi News

- Hubble Tension Solved? Study finds evidence of an 'Invisible Bias' in How We Measure the Universe

- Darline Desca Releases "DRIVE." A New Bold English-Language Compas Single

- Mayor Brandon Johnson Appoints Susan Cappello as Executive Director of Chicago Animal Care and Control

- Chicago: Mayor Brandon Johnson Statement Condemning the Illegal Rescission of EPAS's Landmark 2009 Greenhouse Gas Endangerment Finding

- LMJ's Lost Souls partnership with Schaumburg Boomers brings in surprise donation

Unlike traditional brokerages, OTH operates a vertically integrated model, enabling multiple value-added revenue streams per transaction, including:

- Financing through its Azure Funding division

- Insurance and warranty products

- Wholesale and retail trade-in capabilities

This structure improves conversion rates, accelerates inventory turn, and enhances margin opportunity—particularly as inventory scale increases.

Inventory Financing Expanded to $60 Million to Fuel 2026 Growth

In one of its most important growth moves, OTH announced on January 20, 2026, that it has expanded its inventory financing floorplan to $60 million, more than doubling capacity following its 2025 IPO.

This expanded facility allows the company to:

- Carry more high-quality used inventory across geographies

- Increase customer match rates and reduce transaction friction

- Support faster sales velocity and higher overall throughput

Management believes the additional floorplan capacity is a key driver behind its 2026 revenue projection of $140–$145 million.

Strategic Dealer Incentive Program with flyExclusive

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the largest private aviation operators in the U.S.

Under the program, high-performing dealers can earn private aviation flight hours, a premium incentive designed to:

- Deepen dealer engagement

- Increase both the quantity and value of boat intake

- Accelerate transaction volume across the national network

The partnership uniquely aligns two publicly traded, service-driven platforms and further differentiates OTH's acquisition and brokerage ecosystem.

Autograph Yacht Group Gains Rapid Traction in Luxury Segment

OTH's Autograph Yacht Group, launched in October 2025, is already delivering strong momentum in the luxury brokerage segment.

Key early results include:

- $100 million in active listings secured

- 22 closed transactions totaling $35 million

- Focus on yachts ranging from $500,000 to $20+ million

Unlike traditional luxury brokers, Autograph embraces trade-ins, powered by OTH's proprietary AI platform—creating a clear structural advantage in pricing accuracy, deal velocity, and client experience.

More on illi News

- Boonuspart.ee Acquires Kasiino-boonus.ee to Strengthen Its Position in the Estonian iGaming Market

- Vines of Napa Launches Partnership Program to Bolster Local Tourism and Economic Growth

- Finland's €1.3 Billion Digital Gambling Market Faces Regulatory Tug-of-War as Player Protection Debate Intensifies

- Angels Of Dirt Premieres on Youtube, Announces Paige Keck Helmet Sponsorship for 2026 Season

- "They Said It Was Impossible": This Bottle Turns Any Freshwater Source Into Ice-Cold, Purified Drinking Water in Seconds

The division operates from waterfront offices in Jupiter and Fort Lauderdale, placing it squarely in one of the most active luxury boating corridors in the U.S.

Strong Operating Momentum and 2026 Outlook

For the third quarter ended September 30, 2025, OTH reported:

- Revenue: $24.0 million

- Record nine-month revenue: $82.6 million (+19.3% YoY)

- Boats sold: 112 units (+51% YoY)

- Adjusted EBITDA: $0.5 million

- Gross profit: $3.0 million

Despite near-term public-company transition costs following its November 2025 IPO, the company delivered its second-highest quarterly unit sales in history and issued full-year 2026 revenue guidance of $140–$145 million.

$1 Million Share Repurchase Signals Management Confidence

On January 8, OTH's board authorized a $1.0 million share repurchase program, citing a disconnect between the company's market capitalization and its intrinsic value.

"Today's stock price does not fully reflect the underlying value of our business," said CEO Brian John. "This authorization underscores our confidence in the strategy and our commitment to disciplined capital allocation."

With approximately $100 million in boat listings annually, management believes the company's current valuation significantly understates its platform scale and earnings power.

Investment Takeaway

Off The Hook YS Inc. enters 2026 with:

- A $10 analyst price target

- Expanded $60 million inventory financing

- Accelerating dealer and luxury brokerage momentum

- AI-driven operational leverage

- A shareholder-friendly buyback program

As OTH scales revenue toward $145 million and continues executing on its technology-enabled model, investors may increasingly view the company as a mispriced growth platform in a large, durable marine market.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on illi News

- The Rise of Comprehensive Home Water Treatment Systems

- Yazaki Innovations to Introduce First-Ever Prefabricated Home Wiring System to U.S. Residential Market in 2026

- Bisnar Chase Named 2026 Law Firm of the Year by Best Lawyers

- Ace Industries Welcomes Jack Polish as Controller

- Senseeker Machining Company Acquires Axis Machine to Establish Machining Capability for Improved Supply Chain Control and Shorter Delivery Times

- VC Fast Pitch Is Coming to Maryland on March 26th

- Patent Bar Exam Candidates Achieve 30% Higher Pass Rates with Wysebridge's 2026 Platform

- Cures Within Reach Selected Seven More Clinical Trials to Address Factors that Lead to High Disease Burden in Low and Lower-Middle Income Countries

- Municipal Carbon Field Guide Launched by LandConnect -- New Revenue Streams for Cities Managing Vacant Land

- Hoy Law Wins Supreme Court Decision Establishing Federal Trucking Regulations as the Standard of Care in South Dakota

- People Have to Eat: Local Startup Joins the Fight Against Food Insecurity

- Dr. Rashad Richey's Indisputable Shatters Records, Over 1 Billion YouTube Views, Top 1% Podcast, 3.2 Million Viewers Daily

- Kettera Expands Hydra Platform with Two New Specialist Commodity Managers

- Grand Opening: New Single-Family Homes Now Open for Sale at Heritage at Manalapan

- Shelter Structures America Announces Distribution Partnership with The DuraTrac Group

- The OpenSSL Corporation Releases Its Annual Report 2025

- Iranian-Born Engineer Mohsen Bahmani Introduces Propeller-Less Propulsion for Urban Air Mobility

- Aleen Inc. (C S E: ALEN.U) Advances Digital Wellness Vision with Streamlined Platform Navigation and Long-Term Growth Strategy

- RimbaMindaAI Officially Launches Version 3.0 Following Strategic Breakthrough in Malaysian Market Analysis

- Fed Rate Pause & Dow 50k: Irfan Zuyrel on Liquidity Shifts, Crypto Volatility, and the ASEAN Opportunity