Trending...

- Super League (N A S D A Q: SLE) Enters Breakout Phase: New Partnerships, Zero Debt & $20 Million Growth Capital Position Company for 2026 Acceleration

- Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH)

- myLAB Box Expands, Becoming the First and Only At-Home Testing Company to Serve the Entire Family—Human and Furry—with New Pet Intolerance Test

$IQSTD Also Signs MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Plus $1 Million Subsidiary Sale with Stock Dividend to Shareholders. iQSTEL, Inc. (Stock Symbol: IQSTD)

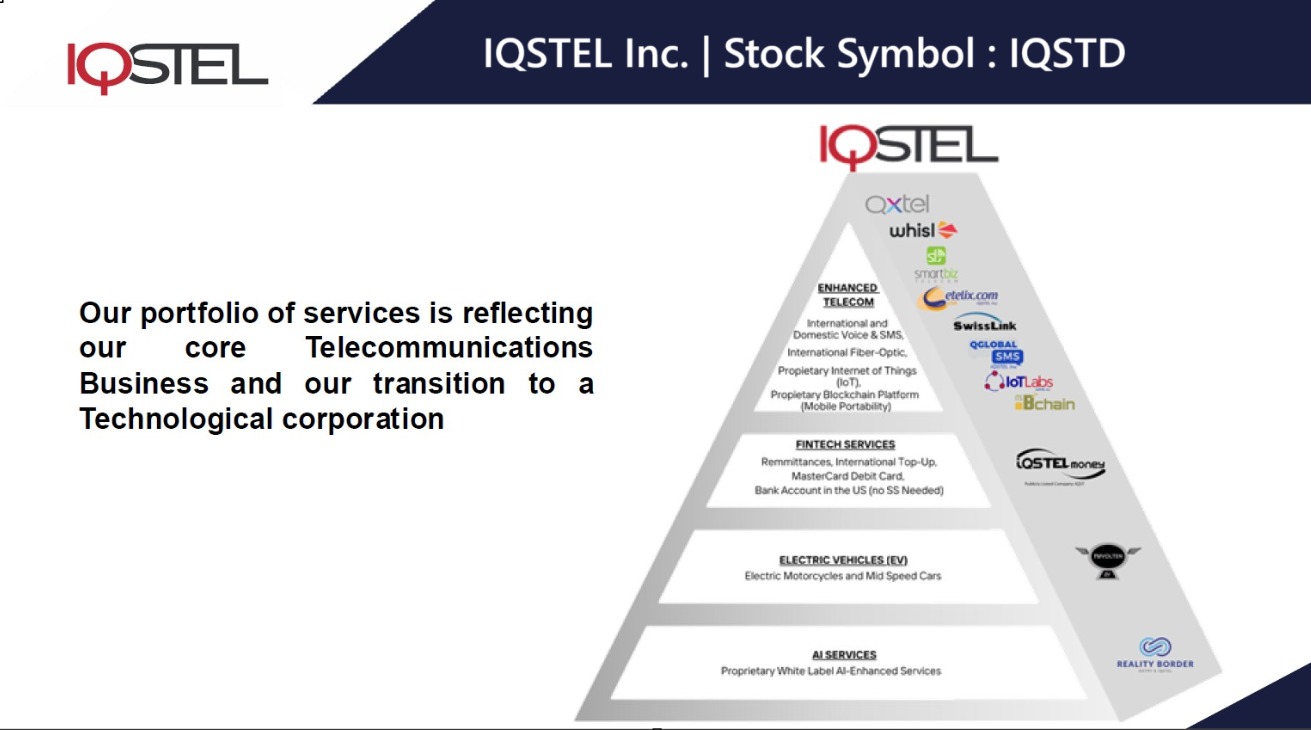

CORAL GABLES, Fla. - illiNews -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

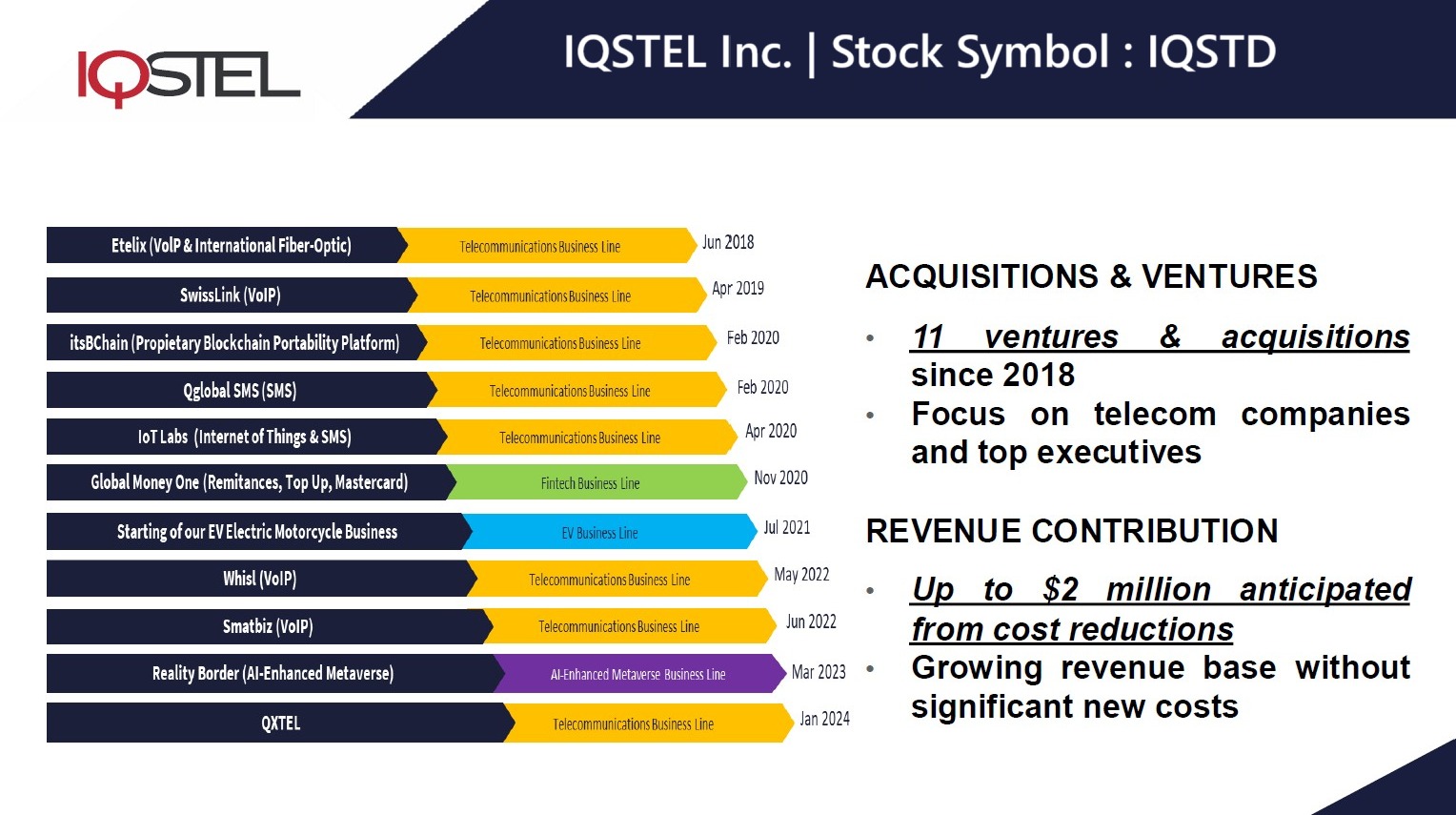

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

The Company's common stock began trading on a split-adjusted basis on the OTCQX under the trading symbol "IQSTD" as of May 2nd. The fifth character "D" will be removed from the Company's trading symbol after 20 business days if the stock is still trading on the OTCQX, or upon the listing of the Company's common stock on Nasdaq, whichever occurs first. At that time, the Company's trading symbol will revert to "IQST."

Leandro Jose Iglesias President & CEO of IQSTD stated, "Our management team firmly believes that IQSTEL's current market capitalization on the OTC market does not reflect the true value of our company, especially considering our outstanding performance and solid financial foundation. We are confident that a NASDAQ listing will bring our market value more in line with our real business strength."

More on illi News

Key Facts Supporting the IQSTD NASDAQ Uplisting

Revenue Growth: In 2024, IQSTD reported $283 million in revenue, yet market capitalization remains at only about 10% of that figure.

Explosive Growth: IQSTD achieved 96% year-over-year revenue growth, but valuation has not kept pace with performance.

Strong Asset Base: With $79 million in assets, IQSTD valuation still reflects only a fraction of its balance sheet strength.

Proven Profitability: The IQSTD core telecom division generates positive adjusted EBITDA and net income, confirming the scalability of the Company's business model.

Revenue Per Share vs. Stock Price: IQSTD reported $1.40 in revenue per share in 2024, while the stock price trades at less than 10% of that figure.

Global Reach: With operations in over 20 countries and direct B2B relationships with major telecom operators, a NASDAQ listing is expected to enhance IQSTD global visibility and allow partners, customers, and vendors worldwide to invest in the Company — opening the door to thousands of new potential shareholders.

NASDAQ listing opens a new era of opportunities for IQSTD

Enhanced Credibility: The IQSTD uplisting solidifies relationships with key customers who value transparency and the governance standards of a national exchange.

Accelerated M&A: The uplisting enables acquisitions and mergers with larger, high-quality companies as IQSTD persues its roadmap to become a $1 billion revenue company with sustainable profitability.

Institutional Access: IQSTD will be on the radar of institutional investors and leading technology firms—many of whom are restricted by their investment policies from investing in OTC-listed or sub-$3 stocks.

Visibility to Tech Buyers: Increased exposure to global tech corporations seeking to acquire fast-growing, revenue-generating platforms. IQSTD has built a world-class, scalable, and hard-to-replicate global connectivity infrastructure that is ready for expansion. A NASDAQ listing helps solidify and highlight the intrinsic value of the Company's business infrastructure.

Short Seller Protection: The current uplisting also helps mitigate the negative effects of short selling, thanks to NASDAQ's stronger regulatory framework.

A Direct Listing—With No Dilution

IQSTD is not raising capital as part of the uplisting because it already meets the required stockholders' equity requirement. This approach avoids dilution and preserves shareholder value. Additionally, the Company's main investors have extended the maturity of their instruments to Q1 2026, providing greater stability and reaffirming their confidence in the IQSTD long-term trajectory.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

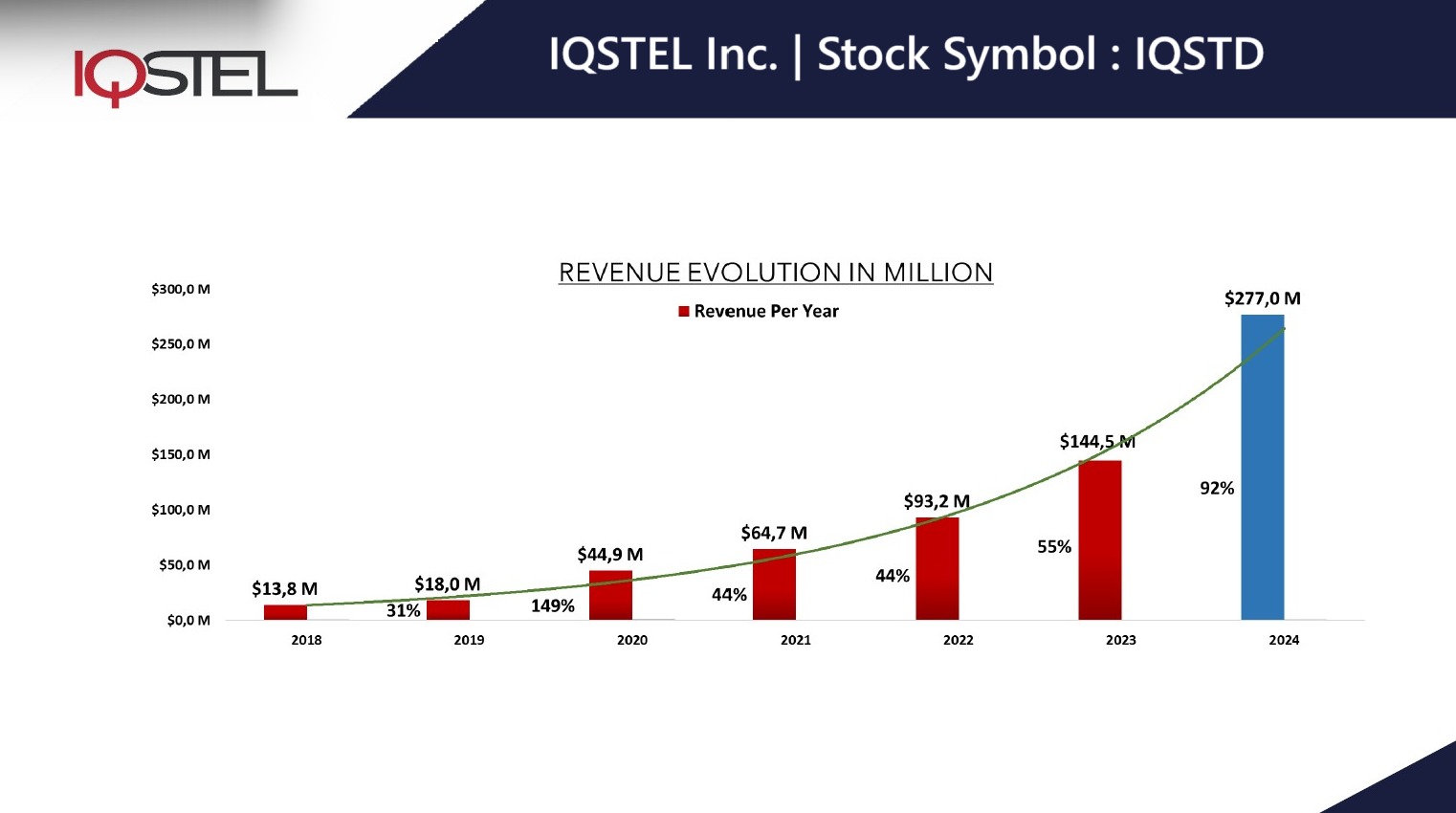

On March 31st IQSTD announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQSTD has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

IQSTD organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

More on illi News

Key Takeaways from the IQSTD 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQSTD subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQSTD is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQSTD will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQSTD plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQSTD fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

Positioned to Achieve $1 Billion in Revenue by 2027 Through Organic Growth, Acquisitions and High-Margin Product Expansion.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% YOY Growth and Expanding $79 Million Asset Base.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

MOU for Strategic Sale of BChain Subsidiary to Accredited Solutions, Inc. (ASII).

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

iQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

The Company's common stock began trading on a split-adjusted basis on the OTCQX under the trading symbol "IQSTD" as of May 2nd. The fifth character "D" will be removed from the Company's trading symbol after 20 business days if the stock is still trading on the OTCQX, or upon the listing of the Company's common stock on Nasdaq, whichever occurs first. At that time, the Company's trading symbol will revert to "IQST."

Leandro Jose Iglesias President & CEO of IQSTD stated, "Our management team firmly believes that IQSTEL's current market capitalization on the OTC market does not reflect the true value of our company, especially considering our outstanding performance and solid financial foundation. We are confident that a NASDAQ listing will bring our market value more in line with our real business strength."

More on illi News

- Illinois 45th District Candidate Josh Atkinson Introduces a New Way to Reach Voters

- Kentucky Judges Ignore Evidence, Prolong Father's Ordeal in Baseless Case

- Contracting Resources Group Receives 2025 HIRE Vets Platinum Medallion Award from the U.S. Department of Labor

- Suburban Orthopaedics Expands Spine Team with Board-Certified Surgeon Joseph Brindise, DO

- Naperville: Drive Sober or Get Pulled Over This Season

Key Facts Supporting the IQSTD NASDAQ Uplisting

Revenue Growth: In 2024, IQSTD reported $283 million in revenue, yet market capitalization remains at only about 10% of that figure.

Explosive Growth: IQSTD achieved 96% year-over-year revenue growth, but valuation has not kept pace with performance.

Strong Asset Base: With $79 million in assets, IQSTD valuation still reflects only a fraction of its balance sheet strength.

Proven Profitability: The IQSTD core telecom division generates positive adjusted EBITDA and net income, confirming the scalability of the Company's business model.

Revenue Per Share vs. Stock Price: IQSTD reported $1.40 in revenue per share in 2024, while the stock price trades at less than 10% of that figure.

Global Reach: With operations in over 20 countries and direct B2B relationships with major telecom operators, a NASDAQ listing is expected to enhance IQSTD global visibility and allow partners, customers, and vendors worldwide to invest in the Company — opening the door to thousands of new potential shareholders.

NASDAQ listing opens a new era of opportunities for IQSTD

Enhanced Credibility: The IQSTD uplisting solidifies relationships with key customers who value transparency and the governance standards of a national exchange.

Accelerated M&A: The uplisting enables acquisitions and mergers with larger, high-quality companies as IQSTD persues its roadmap to become a $1 billion revenue company with sustainable profitability.

Institutional Access: IQSTD will be on the radar of institutional investors and leading technology firms—many of whom are restricted by their investment policies from investing in OTC-listed or sub-$3 stocks.

Visibility to Tech Buyers: Increased exposure to global tech corporations seeking to acquire fast-growing, revenue-generating platforms. IQSTD has built a world-class, scalable, and hard-to-replicate global connectivity infrastructure that is ready for expansion. A NASDAQ listing helps solidify and highlight the intrinsic value of the Company's business infrastructure.

Short Seller Protection: The current uplisting also helps mitigate the negative effects of short selling, thanks to NASDAQ's stronger regulatory framework.

A Direct Listing—With No Dilution

IQSTD is not raising capital as part of the uplisting because it already meets the required stockholders' equity requirement. This approach avoids dilution and preserves shareholder value. Additionally, the Company's main investors have extended the maturity of their instruments to Q1 2026, providing greater stability and reaffirming their confidence in the IQSTD long-term trajectory.

$1.40 Revenue Per Share and $283.2 Million in Revenue, Fueling 95.9% Year Over Year Growth and Expanding $79 Million Asset Base to Drive Innovation

On March 31st IQSTD announced its 2024 financial results, highlighting exponential growth, a stronger business foundation, and an expanding vision beyond telecom.

With $283.2 million in revenue, a 95.9% year-over-year increase, and a significant boost in profitability across operating subsidiaries, IQSTD has not only built a telecom powerhouse but has also been laying the foundation for a diversified, high-tech, high-margin business platform. This platform will fuel expansion into Fintech, AI-driven services, and other cutting-edge technologies, maximizing growth opportunities.

IQSTD organic growth, led by Etelix, Swisslink, and IoT Labs—was further accelerated by the transformational QXTEL acquisition, reinforcing its dominance in global telecom while opening new pathways into high-value technology sectors.

More on illi News

- Crunchbase Ranks Phinge Founder & CEO Robert DeMaio #1 Globally. Meet him in Las Vegas-Week of CES to Learn About Netverse, Patented App-less Platform

- Fintravion Business Academy(FBA)Under Adrian T. Langshore Advances FintrionAI 6.0 Architecture

- Bensenville cleaning company offers free home cleaning for cancer patients

- IODefi Introduces New Web3 Infrastructure Framework as XRP Ledger Development Gains Global Attention

- Terizza Forms Strategic Collaboration with UC San Diego to Pioneer Next-Generation Distributed AI Infrastructure

Key Takeaways from the IQSTD 2024 Financials:

Unprecedented Growth: Revenue increased 95.9% from $144.5 million in FY-2023, to $283.2 million in revenue in FY-2024, nearly doubling in just one year.

Operating Subsidiaries' Adjusted EBITDA: IQSTD subsidiaries surpassed $2.5 million in Adjusted EBITDA, showing our ability to generate sustainable profits.

Massive Asset Growth: Total assets surged to $79.0 million, up from $22.2 million in 2023, a remarkable 257% increase.

Strengthened Stockholder Equity: Grew 48% to $11.9 million, up from $8.0 million in 2023.

Revenue Per Share: Soared to $1.40 in 2024 vs. $0.84 in 2023, an impressive 66.67% improvement.

In 2025 IQSTD is set to maximize efficiency, strengthening its financial position, and accelerating transition toward high-margin technology-driven services.

1. Cost Efficiency & Savings Initiatives by implementing a structured cost-saving plan to generate up to $1 million in annual savings while maintaining strong growth momentum.

$500,000 in yearly savings already secured through optimized wage structures.

$300,000 in additional yearly savings starting in Q3 2025, driven by a unified technology platform across subsidiaries.

$200,000 more in yearly savings starting late 2025, through enhanced operational efficiencies.

2. Continued Business Consolidation for Maximum Productivity & Growth. Following the success of Etelix & Swisslink's integration at the operational level, IQSTD will further streamline telecom operations, optimizing efficiency, reducing costs, and enhancing overall value creation.

3. Debt Reduction Strategy.

IQSTD plans to complete all QXTEL-related payments in 2025, reinforcing financial flexibility and strategic positioning for continued expansion.

4. Growth Targets for 2025:

Revenue Target: $340 million.

Adjusted EBITDA (operating businesses): Expected to exceed $3 million (excluding new potential acquisitions).

Globetopper Potential Acquisition

Expected to push revenue toward a $400 million run rate.

Strengthening IQSTD fintech-driven profitability by expanding high-margin financial technology services.

Transforming the revenue mix to 80% Telecom / 20% Fintech, unlocking higher margins and long-term shareholder value.

5. Additional Strategic Acquisitions for Accelerated Growth

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

6. Expanding High-Tech, High-Margin Offerings Through Global Business Platform

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on illi News

- Hyatt House Fresno Celebrates Grand Opening, Introducing the First Hyatt House in Fresno, California

- "I Make Music Not Excuses" Journal by Anthony Clint Jr. Becomes International Amazon Best Seller, Empowering Music Creators Worldwide

- Ace Watkins (Public Announcement)Elevates R&B with New Single "Higher" a Soulful Slow-burning Anthem

- DanReDev, Kaufman Development & Oldivai Announce Major 2026 Projects Nationwide

- Accelerating Precious Metals Expansion and Digital Asset Innovation Ahead of 2026: Asia Broadband Inc. (Stock Symbol: AABB)

- Naturism Resurgence (NRE) Announces the World's First Standardised Stigma Measure (SSM) for Naturism

- London Art Exchange Emerges as a Leading Force in UK Contemporary Art, Elevating Three Artists to Secondary-Market Success

- myLAB Box Expands, Becoming the First and Only At-Home Testing Company to Serve the Entire Family—Human and Furry—with New Pet Intolerance Test

- Entering 2026 with Expanding Footprint, Strong Industry Tailwinds, and Anticipated Q3 Results: Off The Hook YS Inc. (N Y S E American: OTH)

- ❄️ Winter Feature: Stay Comfortable at Cold-Weather Events

- Tiger-Rock Martial Arts Appoints Jami Bond as Vice President of Growth

- Super League (N A S D A Q: SLE) Enters Breakout Phase: New Partnerships, Zero Debt & $20 Million Growth Capital Position Company for 2026 Acceleration

- Finland's Gambling Reform Promises "Single-Click" Block for All Licensed Sites

- Private Keys Are a Single Point of Failure: Security Advisor Gideon Cohen Warns MPC Technology Is Now the Only Defense for Institutional Custody

- Compliance Is the Ticket to Entry: Legal Advisor Gabriela Moraes Analyzes RWA Securitization Paths Under Brazil's New Legislation

- Coalition and CCHR Call on FDA to Review Electroshock Device and Consider a Ban

- Spark Announces 2025 Design Award Winners

- Weekend Recap: Mayor Brandon Johnson Attends Quarter Zip Link Up, Joins Communities Across Chicago To Celebrate Holiday Season

- NEW Luxury Single-Family Homes Coming Soon to Manalapan - Pre-Qualify Today for Priority Appointments

- Dominic Pace Returns to the NCIS Franchise With Guest Role on NCIS: Origins