Trending...

- Georgia's Lanier Islands Resort Tees Up for a New Era of Golf in Spring 2026

- Inkdnylon Simplifies Digitizing and Vector Art Nationwide With Clear Pricing and Guided File Support

- Chicago: Mayor Brandon Johnson Statement on The Trump Administration's Baseless Arrest of Don Lemon

Off The Hook YS Inc. (NYSE American: OTH) $OTH Also Commences $1 Million Share Repurchase Program to Highlight Undervaluation of $100 Million in Listings Annually

WILMINGTON, N.C. - illiNews -- Off The Hook YS Inc. (NYSE American: OTH) is quietly transforming the fragmented pre-owned boat and yacht market into a scalable, tech-enabled liquidity platform—and recent developments suggest 2026 could mark a breakout year.

Fresh off its 2025 IPO, OTH is pairing accelerating operational momentum with strategic capital allocation and an innovative dealer incentive partnership that blends marine brokerage with private aviation. For investors seeking exposure to a $57 billion U.S. marine industry with improving transparency, velocity, and margins, OTH is becoming increasingly difficult to ignore.

A Category Builder in a Massive Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across the East Coast and South Florida, offering brokerage, wholesale, performance yacht sales, and marine finance through its Azure Funding division.

What differentiates OTH is not just scale—but technology.

The company's AI-assisted valuation engine and data-driven sales platform are designed to bring speed, transparency, and pricing accuracy to a traditionally opaque market. This technology backbone enables faster deal velocity, smarter inventory acquisition, and the ability to profitably transact across multiple price points.

The market opportunity is significant:

OTH appears well positioned to act as a liquidity hub within this expanding ecosystem.

Strategic Partnership with flyExclusive: Incentivizing Growth at Scale

In January, OTH announced a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the leading private aviation operators in the U.S.

More on illi News

Under the program:

By aligning with flyExclusive, OTH is offering dealers a premium, business-relevant reward that matches the national scale and efficiency of its platform. The result: stronger dealer loyalty, faster inventory acquisition, and increased transaction throughput—key drivers of revenue acceleration heading into 2026.

Signaling Undervaluation: $1 Million Share Repurchase Program

Adding to investor intrigue, OTH authorized a share repurchase program of up to $1 million, signaling management's confidence that the market is undervaluing the company's fundamentals.

With the company handling over $100 million in listings annually, management has made it clear they believe current share prices do not fully reflect:

The buyback will be funded through existing cash and future cash flows, while OTH continues to invest in inventory expansion, technology initiatives, and strategic real estate.

Autograph Yacht Group: Early Proof of Upside in Luxury

Launched in October 2025, Autograph Yacht Group—OTH's boutique luxury brokerage—has delivered immediate traction.

In just its first quarter:

Unlike traditional luxury brokerages, Autograph can accept trade-ins, powered by OTH's AI valuation engine. This capability creates a structural advantage by removing friction from high-value transactions and accelerating deal velocity.

Operating from waterfront offices in Jupiter and Fort Lauderdale, Autograph strengthens OTH's presence in one of the most active luxury boating corridors in the U.S., while generating meaningful synergies across the broader platform.

More on illi News

Financial Momentum and 2026 Outlook

OTH's financial trajectory continues to point upward:

Nine-Month 2025 Highlights

Third Quarter 2025

Looking ahead, management issued 2026 full-year revenue guidance of $140–$145 million, implying a meaningful step-up driven by:

Why Investors Are Paying Attention

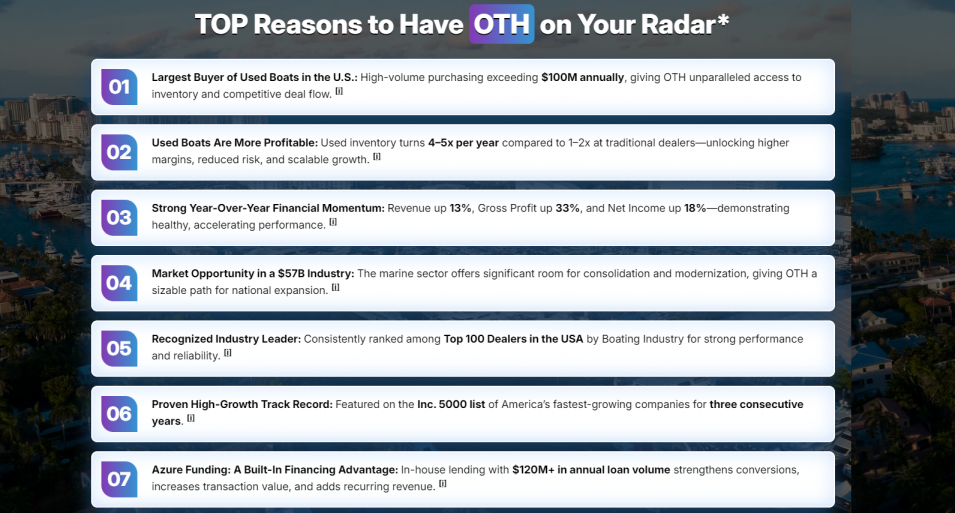

OTH checks multiple boxes that sophisticated investors look for in emerging growth stories:

As Digital BD Deep recently noted in its new research report, "Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market," OTH may be unlocking a form of structural arbitrage by bringing institutional-grade liquidity and analytics to a legacy industry.

Bottom Line

With accelerating dealer engagement, a unique private aviation incentive strategy, early success in luxury brokerage, and management signaling undervaluation through share buybacks, Off The Hook YS Inc. is shaping up as a compelling small-cap growth story heading into 2026.

For investors seeking exposure to the intersection of technology, luxury assets, and a growing marine economy, OTH is increasingly worth a closer look.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Fresh off its 2025 IPO, OTH is pairing accelerating operational momentum with strategic capital allocation and an innovative dealer incentive partnership that blends marine brokerage with private aviation. For investors seeking exposure to a $57 billion U.S. marine industry with improving transparency, velocity, and margins, OTH is becoming increasingly difficult to ignore.

A Category Builder in a Massive Market

Founded in 2012 by Jason Ruegg and headquartered in Wilmington, North Carolina, Off The Hook YS has grown into one of America's largest buyers and sellers of pre-owned boats, acquiring more than $100 million in boats and yachts annually. The company operates a nationwide network of offices and marinas across the East Coast and South Florida, offering brokerage, wholesale, performance yacht sales, and marine finance through its Azure Funding division.

What differentiates OTH is not just scale—but technology.

The company's AI-assisted valuation engine and data-driven sales platform are designed to bring speed, transparency, and pricing accuracy to a traditionally opaque market. This technology backbone enables faster deal velocity, smarter inventory acquisition, and the ability to profitably transact across multiple price points.

The market opportunity is significant:

- $57 billion U.S. marine industry

- $6.55 billion ship repair and maintenance market (2025) projected to grow to $11.72 billion by 2033 at a 7.52% CAGR

OTH appears well positioned to act as a liquidity hub within this expanding ecosystem.

Strategic Partnership with flyExclusive: Incentivizing Growth at Scale

In January, OTH announced a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the leading private aviation operators in the U.S.

More on illi News

- HBMHCW Expande Infraestructura de Cumplimiento para Argentina mientras América Latina Supera $1.5 Billones en Volumen Cripto

- Norisia Launches AI Formulated Luxury Multivitamin to Transform Daily Wellness in the UK

- Free Solar Installation Training Program Opens Pathways to Renewable Energy Careers in Englewood

- City Of Chicago Unveils First Video Animation of The New Concourse D at O'Hare International Airport

- Liquatite® Flexible Conduit Powering Data Centers

Under the program:

- High-performing dealer partners can earn private aviation flight hours

- Incentives are tied directly to transaction volume and performance

- The initiative is designed to increase both the quantity and value of boat intake, deepening dealer engagement nationwide

By aligning with flyExclusive, OTH is offering dealers a premium, business-relevant reward that matches the national scale and efficiency of its platform. The result: stronger dealer loyalty, faster inventory acquisition, and increased transaction throughput—key drivers of revenue acceleration heading into 2026.

Signaling Undervaluation: $1 Million Share Repurchase Program

Adding to investor intrigue, OTH authorized a share repurchase program of up to $1 million, signaling management's confidence that the market is undervaluing the company's fundamentals.

With the company handling over $100 million in listings annually, management has made it clear they believe current share prices do not fully reflect:

- Cash-generation potential

- Technology-driven competitive advantages

- Long-term growth trajectory

The buyback will be funded through existing cash and future cash flows, while OTH continues to invest in inventory expansion, technology initiatives, and strategic real estate.

Autograph Yacht Group: Early Proof of Upside in Luxury

Launched in October 2025, Autograph Yacht Group—OTH's boutique luxury brokerage—has delivered immediate traction.

In just its first quarter:

- $100 million in luxury listings secured

- 22 deals closed totaling $35 million

- Focus on yachts ranging from $500,000 to $20 million+

Unlike traditional luxury brokerages, Autograph can accept trade-ins, powered by OTH's AI valuation engine. This capability creates a structural advantage by removing friction from high-value transactions and accelerating deal velocity.

Operating from waterfront offices in Jupiter and Fort Lauderdale, Autograph strengthens OTH's presence in one of the most active luxury boating corridors in the U.S., while generating meaningful synergies across the broader platform.

More on illi News

- Jacob Emrani's Annual "Supper Bowl" Expected To Donate Thousands Of Meals

- NASA / Glenn Research Center Collaboration to Help Meet Rising Demand for Space Energy Beaming Tech / CIGS PV Modules from Ascent Solar: NAS DAQ: ASTI

- When Interpretation Becomes Conversation: Rethinking Engagement in the Museum Age

- Behind the Scenes: Licensing the Holiday Hideables Concept

- Half of Finnish Online Gambling Expenditure Now Flows to Offshore Instant Casinos as License Applications Open March 1, 2026

Financial Momentum and 2026 Outlook

OTH's financial trajectory continues to point upward:

Nine-Month 2025 Highlights

- Record revenue: $82.6 million, up 19.3% YOY

- Boats sold: 310 units, up 24.4%

- Net income: $0.8 million

- Gross profit: $8.4 million, up $1.5 million YOY

Third Quarter 2025

- Revenue: $24.0 million

- Boats sold: 112 units, up 51% YOY

- Second-highest quarterly unit sales in company history

Looking ahead, management issued 2026 full-year revenue guidance of $140–$145 million, implying a meaningful step-up driven by:

- Increased dealer engagement from the flyExclusive incentive program

- Scaling of Autograph Yacht Group

- Continued technology-enabled efficiency gains

Why Investors Are Paying Attention

OTH checks multiple boxes that sophisticated investors look for in emerging growth stories:

- ✔️ Large, fragmented market ripe for consolidation

- ✔️ Proven technology advantage with AI-driven pricing and matching

- ✔️ Rapid post-IPO operational momentum

- ✔️ Insider confidence via share repurchase authorization

- ✔️ Clear visibility into 2026 revenue growth

As Digital BD Deep recently noted in its new research report, "Off-The-Hook YS Digital Transformation and Margin Inflection in the Marine Industry – Structural Arbitrage in the Marine Liquidity Market," OTH may be unlocking a form of structural arbitrage by bringing institutional-grade liquidity and analytics to a legacy industry.

Bottom Line

With accelerating dealer engagement, a unique private aviation incentive strategy, early success in luxury brokerage, and management signaling undervaluation through share buybacks, Off The Hook YS Inc. is shaping up as a compelling small-cap growth story heading into 2026.

For investors seeking exposure to the intersection of technology, luxury assets, and a growing marine economy, OTH is increasingly worth a closer look.

Company: Off The Hook YS Inc. (NYSE American: OTH)

Website: www.offthehookyachts.com

Investor Media: https://compasslivemedia.com/oth/

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

Filed Under: Business

0 Comments

Latest on illi News

- Market Value Enhancement From 2 Important New US Patents Issued for Strengthening Hair Enzyme Booster Technology to Caring Brands (NAS DAQ: CABR)

- Dr. Billy Laun Will Be Attending An Advanced Airway Management Course by AIME

- HELM Audio™ Partners with PQCrypto to Future-Proof Children's Hearing and Safety Data Using Post-Quantum Cryptography

- Wala Blegay to Announce Run for Congress in Maryland's 5th District on Feb. 4

- Luxury Lake-View Home Launches in Kissimmee's Bellalago community, Offering Privacy, Space, and Florida Resort-Style Living

- Sleep Basil Launches Revamped Diamond Mattress Collection Page, Highlighting Performance, Craftsmanship, and Personalized Comfort

- Sleep Basil Curates a Clearer Brooklyn Bedding Experience for Performance-Minded Denver Sleepers

- Naperville: North Central College Student Charged with Possession of Loaded Gun on Campus

- Nevada Man Launches Nationwide Animal Abuse Registry

- Star-powered Kappa Takeover Weekend Returns to the DMV June 18- 21, 2026, Hosted By Comedian Joe Clair W/ Dj Quick Silva (the Party Kingpin)

- Vault Innovation Group Sponsors AI Action Lab Chicago

- Scoop Social Co. Wins The Knot and WeddingWire Awards as Brand Expands Nationwide

- Chicago-Based Creator Launches Historically Accurate True-Crime Apparel on Kickstarter

- Denise Murphy Lenci Promoted to Century Fasteners Corp. – General Manager, Northeast Sales

- Chicago: Mayor Brandon Johnson, Department of Streets and Sanitation Reveal 25 Finalists for City's Fourth Annual 'You Name A Snowplow' Contest

- TiNY Puts Real Pets on the Payroll for New PetArmor Campaign

- P‑Wave Classics Launches Definitive New Edition of Hannah Webster Foster's The Coquette

- Strategic Expansion with 3 New Alliances — Jefferson Beach Yacht Sales, CFR YS & flyExclusive Incentive Partnership: Off The Hook YS: (N Y S E: OTH)

- Super League (N A S D A Q: SLE) Advances AI-Driven Playable Media with AdArcade, Solsten, and Meta-Stadiums Partnerships, Plus Roblox Theatre Launch

- purelyIV Expands Concierge Wellness Platform with New IV Therapies, Memberships, and Digital Experience