Trending...

- Cold. Clean. Anywhere. Meet FrostSkin

- Chicago: Mayor Brandon Johnson Statement on the Veto of the Proposed Hemp Ban

- Litchfield Cavo Expands California Presence with New Irvine Office

Off The Hook YS Inc. (NYSE American: OTH) $OTH is A Technology-Driven Marine Platform Poised for a Breakout Year

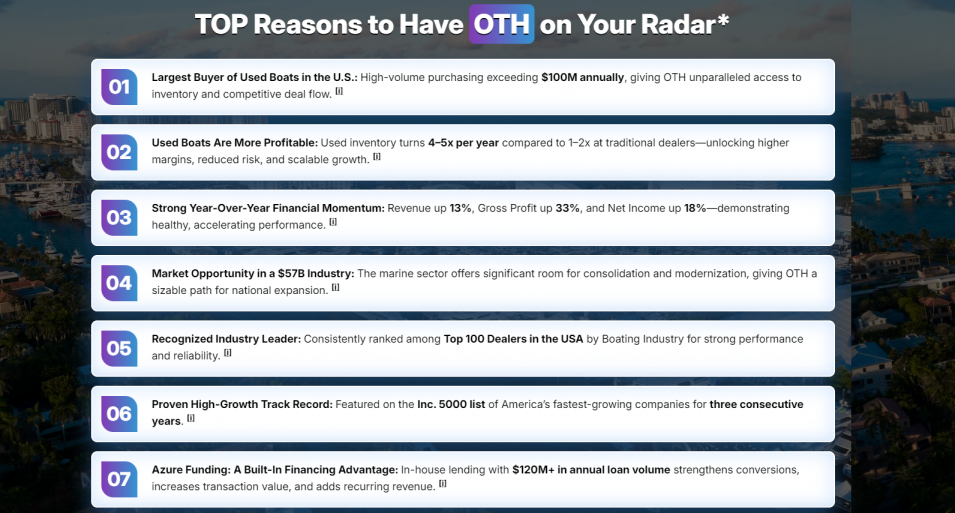

WILMINGTON, N.C. - illiNews -- In an industry long dominated by fragmented dealers and opaque transactions, Off The Hook YS, Inc. (NYSE American: OTH) is quietly building what many investors now recognize as a category-defining platform in the $57 billion U.S. marine industry.

Founded in 2012 by industry veteran Jason Ruegg, Off The Hook has evolved into one of America's largest buyers and sellers of pre-owned boats and yachts, acquiring more than $100 million in vessels annually and operating a nationwide network of offices and marinas across multiple states. Following its successful 2025 IPO, OTH has entered 2026 with accelerating momentum, expanding inventory capacity, international reach, and growing validation from institutional research.

$100 Million in New Listings and a Rapidly Scaling Luxury Platform

One of the most compelling recent developments is the breakout performance of Autograph Yacht Group, OTH's newly launched luxury brokerage division.

Autograph focuses on yachts ranging from $500,000 to $20 million+, offering a boutique, high-touch brokerage experience while leveraging OTH's proprietary AI-driven valuation and matching engine. Unlike traditional luxury brokerages, Autograph can seamlessly accept trade-ins—unlocking liquidity and accelerating deal velocity in a segment historically resistant to innovation.

This early traction underscores the scalability of OTH's vertically integrated model and highlights its ability to move upstream into higher-margin market segments without sacrificing speed or transparency.

Strategic Expansion into the Caribbean & Latin America

On January 26, OTH announced a strategic agreement with CFR Yacht Sales, a leading yacht dealer and brokerage based in San Juan, Puerto Rico. The partnership marks OTH's first major step into the Caribbean and Latin American markets, regions known for strong demand in premium pre-owned vessels and limited institutional infrastructure.

More on illi News

Under the agreement:

This expansion builds directly on OTH's core strength—efficiently aggregating, valuing, and distributing pre-owned inventory—while opening new international supply channels that can materially increase deal flow in 2026 and beyond.

Inventory Financing Expanded to $60 Million: Fuel for Accelerated Growth

On January 20, OTH announced a major expansion of its inventory financing floorplan to $60 million, more than doubling capacity from pre-IPO levels. This move significantly enhances OTH's ability to acquire and carry high-quality used inventory across key geographies and categories.

The impact is meaningful:

In a supply-constrained market, capital access and inventory intelligence are decisive advantages—and OTH now has both at scale.

Dealer Engagement Reinvented: flyExclusive Partnership

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the nation's leading private aviation operators.

High-performing dealer partners can now earn private aviation flight hours as part of a performance-based incentive structure—an innovative reward aligned with the lifestyle and efficiency demands of top marine professionals.

By blending marine and aviation platforms at a national scale, OTH is deepening dealer loyalty, increasing intake volume, and further differentiating its acquisition network.

Share Buyback Signals Management Confidence

On January 8, OTH's Board authorized a share repurchase program of up to $1 million, signaling management's view that the current stock price does not reflect the company's intrinsic value.

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead,"

More on illi News

— Brian John, Chief Executive Officer

The buyback will be funded through existing cash and future cash flows, while OTH continues investing in inventory expansion, technology, and strategic growth initiatives—underscoring disciplined, shareholder-aligned capital allocation.

Strong Financial Trajectory in a Growing Market

For the first nine months of 2025, OTH reported record revenue of $82.6 million, representing 19.3% year-over-year growth. Looking ahead, management projects 2026 revenue between $140 million and $145 million, driven by:

Beyond boat sales, OTH is well positioned to benefit from long-term industry tailwinds, including the U.S. Ship Repair and Maintenance Services Market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.52% CAGR.

Institutional Validation: Think Equity Initiates Coverage

In January 2026, Think Equity initiated coverage on OTH with a $10 per share price target, highlighting what it views as a disconnect between market valuation and business fundamentals.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation. With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

This initiation provides third-party validation of OTH's strategy, execution, and long-term upside.

The Bottom Line

Off The Hook YS, Inc. is no longer just a successful boat dealer—it is rapidly becoming a technology-enabled marine commerce platform with national scale, international expansion, and multiple embedded growth engines.

With:

OTH enters 2026 positioned for what could be its most transformative year yet.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Founded in 2012 by industry veteran Jason Ruegg, Off The Hook has evolved into one of America's largest buyers and sellers of pre-owned boats and yachts, acquiring more than $100 million in vessels annually and operating a nationwide network of offices and marinas across multiple states. Following its successful 2025 IPO, OTH has entered 2026 with accelerating momentum, expanding inventory capacity, international reach, and growing validation from institutional research.

$100 Million in New Listings and a Rapidly Scaling Luxury Platform

One of the most compelling recent developments is the breakout performance of Autograph Yacht Group, OTH's newly launched luxury brokerage division.

- $100 million in secured listings

- 22 closed transactions totaling $35 million

- Achieved within the first quarter of operations since its October launch

Autograph focuses on yachts ranging from $500,000 to $20 million+, offering a boutique, high-touch brokerage experience while leveraging OTH's proprietary AI-driven valuation and matching engine. Unlike traditional luxury brokerages, Autograph can seamlessly accept trade-ins—unlocking liquidity and accelerating deal velocity in a segment historically resistant to innovation.

This early traction underscores the scalability of OTH's vertically integrated model and highlights its ability to move upstream into higher-margin market segments without sacrificing speed or transparency.

Strategic Expansion into the Caribbean & Latin America

On January 26, OTH announced a strategic agreement with CFR Yacht Sales, a leading yacht dealer and brokerage based in San Juan, Puerto Rico. The partnership marks OTH's first major step into the Caribbean and Latin American markets, regions known for strong demand in premium pre-owned vessels and limited institutional infrastructure.

More on illi News

- ZRCalc™ Cinema Card Calculator Now Available for Nikon ZR Shooters

- Chicago: Mayor's Office Statement on State's Attorney's Charging Protocol for Federal Immigration Agents

- Mayor Brandon Johnson Releases 2025 Youth Impact Report, Highlighting Transformative Investments in Young Chicagoans

- Chicago: Mayor Brandon Johnson Welcomes CPS Students to City Hall for Inaugural Youth Media Day

- The Data Diva Talks Privacy Podcast with Tom Kemp of The California Privacy Protection Agency

Under the agreement:

- OTH gains preferred access to select brokerage and trade-generated vessels

- CFR supports sourcing, verification, logistics, and regional wholesale visibility

- OTH gains access to brokerage facilities and inventory in Puerto Rico

This expansion builds directly on OTH's core strength—efficiently aggregating, valuing, and distributing pre-owned inventory—while opening new international supply channels that can materially increase deal flow in 2026 and beyond.

Inventory Financing Expanded to $60 Million: Fuel for Accelerated Growth

On January 20, OTH announced a major expansion of its inventory financing floorplan to $60 million, more than doubling capacity from pre-IPO levels. This move significantly enhances OTH's ability to acquire and carry high-quality used inventory across key geographies and categories.

The impact is meaningful:

- Broader selection drives higher conversion rates

- Increased inventory improves turn times and pricing power

- AI-assisted matching accelerates transaction velocity

- Vertical integration enables value-added upsells such as financing, insurance, and warranties

In a supply-constrained market, capital access and inventory intelligence are decisive advantages—and OTH now has both at scale.

Dealer Engagement Reinvented: flyExclusive Partnership

On January 15, OTH launched a nationwide dealer incentive program through a strategic partnership with flyExclusive, Inc. (NYSE American: FLYX), one of the nation's leading private aviation operators.

High-performing dealer partners can now earn private aviation flight hours as part of a performance-based incentive structure—an innovative reward aligned with the lifestyle and efficiency demands of top marine professionals.

By blending marine and aviation platforms at a national scale, OTH is deepening dealer loyalty, increasing intake volume, and further differentiating its acquisition network.

Share Buyback Signals Management Confidence

On January 8, OTH's Board authorized a share repurchase program of up to $1 million, signaling management's view that the current stock price does not reflect the company's intrinsic value.

"Today's stock price and market capitalization do not, in management's view, fully reflect the underlying value of our business, our cash-generation potential, or the long-term opportunity we see ahead,"

More on illi News

- Patent-Pending Athletic Mouthguard with Integrated Inhaler Respirator Offers On-Demand Medication Access During Sports Play

- Revolutionary Data Solution Transforms Health Insurance Underwriting Accuracy

- $36 Million LOI to Acquire High Value Assets from Vivakor Inc in Oklahoma's STACK Play — Building Cash Flow and Scalable Power Infrastructure; $OLOX

- Kobie Wins for AI Innovations in the 2026 Stevie® Awards for Sales & Customer Service

- Berman | Sobin | Gross LLP Celebrates 35 Years of Advocating for Maryland's Injured Workers and Families

— Brian John, Chief Executive Officer

The buyback will be funded through existing cash and future cash flows, while OTH continues investing in inventory expansion, technology, and strategic growth initiatives—underscoring disciplined, shareholder-aligned capital allocation.

Strong Financial Trajectory in a Growing Market

For the first nine months of 2025, OTH reported record revenue of $82.6 million, representing 19.3% year-over-year growth. Looking ahead, management projects 2026 revenue between $140 million and $145 million, driven by:

- Expanded inventory capacity

- International sourcing channels

- Luxury brokerage momentum

- Dealer engagement initiatives

- Continued adoption of AI-assisted valuation tools

Beyond boat sales, OTH is well positioned to benefit from long-term industry tailwinds, including the U.S. Ship Repair and Maintenance Services Market, projected to grow from $6.55 billion in 2025 to $11.72 billion by 2033 at a 7.52% CAGR.

Institutional Validation: Think Equity Initiates Coverage

In January 2026, Think Equity initiated coverage on OTH with a $10 per share price target, highlighting what it views as a disconnect between market valuation and business fundamentals.

"OTH represents a unique opportunity to acquire a high-growth platform trading at a distressed valuation. With a verified revenue trajectory toward $145 million, a proven technology-driven model, and shareholder-aligned capital allocation, OTH is poised for a significant re-rating."

This initiation provides third-party validation of OTH's strategy, execution, and long-term upside.

The Bottom Line

Off The Hook YS, Inc. is no longer just a successful boat dealer—it is rapidly becoming a technology-enabled marine commerce platform with national scale, international expansion, and multiple embedded growth engines.

With:

- $100M+ annual vessel acquisitions

- $60M inventory capacity

- AI-powered valuation and matching

- Luxury brokerage traction

- International expansion

- Shareholder-friendly capital actions

OTH enters 2026 positioned for what could be its most transformative year yet.

For more information:

🌐 www.offthehookyachts.com

🌐 https://compasslivemedia.com/oth

Company: Off The Hook YS Inc. (NYSE American: OTH)

Investor Contact:

Chad Corbin, Chief Financial Officer

📧 IR@offthehookys.com

📞 (561) 374-0513

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: CorporateAds

0 Comments

Latest on illi News

- From Sleepless Nights to Sold-Out Drops: Catch Phrase Poet's First Year Redefining Motivational Urban Apparel

- Cold. Clean. Anywhere. Meet FrostSkin

- How Specialized Game Development Services Are Powering the Next Wave of Interactive Entertainment

- Don't Settle for a Lawyer Who Just Speaks Spanish. Demand One Who Understands Your Story

- Dan Williams Promoted to Century Fasteners Corp. – General Manager, Operations

- Ski Johnson Inks Strategic Deals with Three Major Food Chain Brands

- NIL Club Advances Agent-Free NIL Model as Oversight Intensifies Across College Athletics

- Atlanta Magazine Names Dr. Rashad Richey One of Atlanta's Most Influential Leaders in 2026 as the FIFA World Cup Approaches

- Apostle Margelee Hylton Announces the Release of Third Day Prayer

- Slotozilla Reports Strong Q4 Growth and Sigma Rome Success

- Midwest Pond Features & Landscape Reminds Chicagoland Pond Owners Early-Bird Spring Cleanout Savings

- "Lights Off" and Laughs On: Joseph Neibich Twists Horror Tropes in Hilariously Demonic Fashion

- Families Gain Clarity: Postmortem Pathology Expands Private Autopsy Services in St. Louis

- The Lashe Celebrates Lash Artists with Valentine's Appreciation Event

- Beethoven: Music of Revolution and Triumph - Eroica

- Grundy County Man Charged with Armed Robbery with a Firearm following Naperville Police Investigation into November 2025 Incident

- Amy Turner Receives 2025 ENPY Partnership Builder Award from The Community Foundation

- Chicago: Mayor Brandon Johnson Statement on the Veto of the Proposed Hemp Ban

- Litchfield Cavo Expands California Presence with New Irvine Office

- Chicago: Joint Statement from the Mayors of America's Largest Cities Regarding Department of Homeland Security Funding Negotiations