Trending...

- Tampa-Based Digital Marketing Agency Launches New Website to Help Local Businesses Grow Online

- Global Families Turn to Young Travelers Concierge Amid Rising Safety Concerns in the U.S

- Meditech International Inc. and Los Angeles Rams Continue Strategic Partnership to Enhance Athlete Performance and Recovery

Statis Fund Launches AI-Assisted Trading Algorithm, Volatis Strategy, with Y Combinator Graduate Quantbase

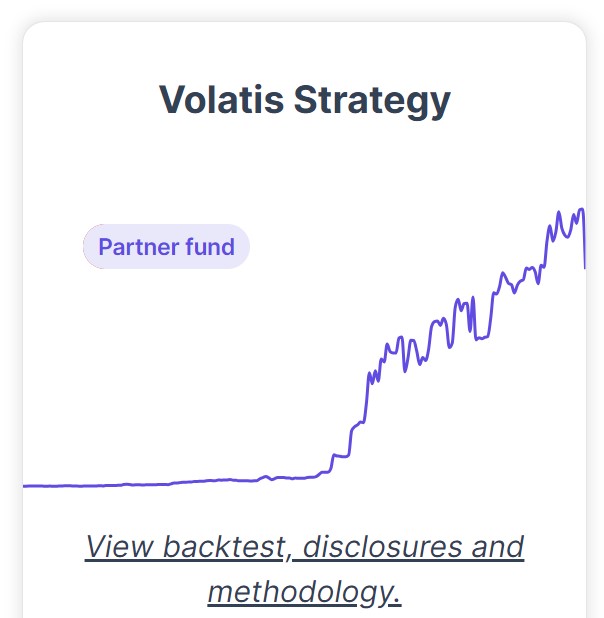

CHICAGO - illiNews -- Statis Fund has announced the launch of Volatis Strategy, managed in partnership by Quantbase, an SEC-registered investment advisor and Y Combinator graduate. Volatis Strategy is Statis Fund's most profitable algorithm based on over 10 years of backtesting data and AI assisted statistical analysis.

The Volatis Strategy is engineered with the intent to capture gains from leveraged ETF funds, protect and improve returns during market downturns, and capture returns amid extreme market volatility while significantly improving drawdowns against leveraged ETFs in certain market conditions. The strategy is grounded in over a decade of AI-assisted data analysis along with YTD out-of-sample performance. Statis Fund's and Quantbase's independently validated backtest results exhibited a compelling 10-year Annualized Rate of Return (ARR) of over 73% after fees.

More on illi News

Early adopter accredited investors receive waived management fees for life with a 20% performance fee until the first million-dollar AUM cut-off. This early adopter incentive underscores the Statis Fund's belief in the potential performance strength the Volatis Strategy presents. Interested parties can now review the strategy on the Quantbase validated strategy page.

Xinyu (Shawn) He, CEO and founder of Statis Fund, remarked, "We have worked closely with Quantbase to launch the Volatis Strategy, with over 10 years of data. The rigorous assessment of our strategy by third parties like Quantbase reflects our dedication to providing investment solutions with strong mathematical fundamentals and investment hypotheses. With our structure we are bringing to market a new model of investment."

The collaboration between Statis Fund and Quantbase aims to set a new standard and rigor in algorithm-based investment strategies leveraging new technologies like AI.

More on illi News

For more information visit Statis Fund and the Quantbase strategy page.

Media Contact:

Xinyu (Shawn) He

Founder, CEO

shawn@statisfund.com

872-267-1949

Disclosures: Past performance and backtests does not guarantee future performance. Nothing here should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Quantbase Investments, Inc., which, along with its affiliates (including Quantbase, LLC, its affiliated registered investment advisor), is partnered with Statis Fund (the promoter). Statis Fund provides tools and services to the financial industry, and therefore is motivated to act as the promoter to promote certain investments created using Statis Fund's tools or services. Quantbase pays Statis Fund a percentage of fees generated from the performance returns and management fees of the managed assets through their partnership.

The Volatis Strategy is engineered with the intent to capture gains from leveraged ETF funds, protect and improve returns during market downturns, and capture returns amid extreme market volatility while significantly improving drawdowns against leveraged ETFs in certain market conditions. The strategy is grounded in over a decade of AI-assisted data analysis along with YTD out-of-sample performance. Statis Fund's and Quantbase's independently validated backtest results exhibited a compelling 10-year Annualized Rate of Return (ARR) of over 73% after fees.

More on illi News

- This Budget Didn't Break the System—It Exposed the Truth

- Statement From EWTN Chairman & CEO Michael P. Warsaw On The Election of Pope Leo XIV

- NBA Champion Lamar Odom Launches Anti-Addiction Meme Coin, Ushering in a Disruptive Innovation in Web3

- Mentor Agile Empowers Illinois Residents with Free Access To Product Management Training

- Midwest Pond Features & Landscapes Hits 100 Cleanouts This Spring, Expands Services Across Chicago

Early adopter accredited investors receive waived management fees for life with a 20% performance fee until the first million-dollar AUM cut-off. This early adopter incentive underscores the Statis Fund's belief in the potential performance strength the Volatis Strategy presents. Interested parties can now review the strategy on the Quantbase validated strategy page.

Xinyu (Shawn) He, CEO and founder of Statis Fund, remarked, "We have worked closely with Quantbase to launch the Volatis Strategy, with over 10 years of data. The rigorous assessment of our strategy by third parties like Quantbase reflects our dedication to providing investment solutions with strong mathematical fundamentals and investment hypotheses. With our structure we are bringing to market a new model of investment."

The collaboration between Statis Fund and Quantbase aims to set a new standard and rigor in algorithm-based investment strategies leveraging new technologies like AI.

More on illi News

- Aureli Construction Sets the Standard for Seamless Home Additions in Greater Boston

- ScreenPoints Puts Film Investors in the Credits—and in the Money With New FinTech Platform

- Beyond Finance Wins Gold Stevie® Award for Customer Service Department of the Year in 23rd Annual American Business Awards

- Pathways to Adulthood Conference May 17 at Melville Marriott Honoring NYS Assembly Member Jodi Giglio, Suffolk County Legislator Nick Caracappa

- Adster Techologies awarded US Patent for breakthrough innovation in reducing latency in Ad Serving

For more information visit Statis Fund and the Quantbase strategy page.

Media Contact:

Xinyu (Shawn) He

Founder, CEO

shawn@statisfund.com

872-267-1949

Disclosures: Past performance and backtests does not guarantee future performance. Nothing here should be considered an offer, solicitation of an offer, or advice to buy or sell securities. Quantbase Investments, Inc., which, along with its affiliates (including Quantbase, LLC, its affiliated registered investment advisor), is partnered with Statis Fund (the promoter). Statis Fund provides tools and services to the financial industry, and therefore is motivated to act as the promoter to promote certain investments created using Statis Fund's tools or services. Quantbase pays Statis Fund a percentage of fees generated from the performance returns and management fees of the managed assets through their partnership.

Source: Statis Fund, LLC

Filed Under: Business

0 Comments

Latest on illi News

- $56.7 Million Announced in Q1 2025 with Revenue Growth and Progress Toward NASDAQ Uplisting for AI Marketing Company: IQSTEL, Inc. Stock Symbol: IQSTD

- SAVVY MINING raised $500 million and launched BTC.XRP.DOGE cloud mining, increasing investors' returns by 30%

- New National Nonprofit Launches to Capture Firsthand Accounts of Adoption Stories

- The Tide Project Opens at Biennale Architettura 2025 in Venice Amplifying Youth Voices

- Wall Street analysts say BTC.XRP.DOGE cloud mining company SIX MINING is expected to achieve a 5-fold increase, allowing users to easily mine BTC

- Gen X Takes The Reins: New Book Guides Caregivers Juggling Parents, Kids, And Grandkids With Humor And Heart

- Naperville Welcomes Top Global Leaders Through Americas Competitiveness Exchange Visit

- Fray Fitness Launches Memorial Day Sale and Veteran Organization Giveaway

- ABM for Good™ Launches First Project with Build Change

- Local Nonprofit Files Lawsuit Against Trump Administration's Attack on AmeriCorps

- Pregis Honors Partners Driving Measurable Impact with Annual Pregis Purpose Awards

- ImagineX, in Collaboration with Qualys, Launches New mROC Services to Transform Enterprise Cyber Risk Management

- Ditch Micromanagement: New Leadership Book for Results-Driven, Accountability-Based Teams

- Jay Tapp was named Managing Director in British Columbia

- Hubei Heavy Equipment Makes a Striking Appearance at CIMT and Competes with International Brands

- 20 Patents Issued Worldwide, Cementing Company Leadership. First Ever Cable-Free 12-Lead ECG: HeartBeam, Inc. (Stock Symbol: BEAT)

- NASDAQ Uplisting for Higher Market Exposure and Wide Corporate Benefits to AI Boosted Marketing Company On Track Towards $1 Billion Revenue by 2027

- AAR announces investor conference schedule for May and June 2025

- Congressional Men's Health Caucus Shows Bipartisan Consensus and Focus on Prevention, Mental Health, and Closing the Lifespan Gap

- The Alternative AI Architecture That Creates Certainty and Trust - No More Guesses.