Trending...

- Z-CoiL Footwear, Albuquerque's Original Spring Shoe, Steps Into ABC's Shark Tank Season Premiere

- NIUFO Examines European MiCA Regulation's Impact on Digital Asset Trading Markets

- Invisible Wounds Foundation Launches Brain Health Collaborative to Combat Traumatic Brain Injury in Service Members and Prevent Military Suicides

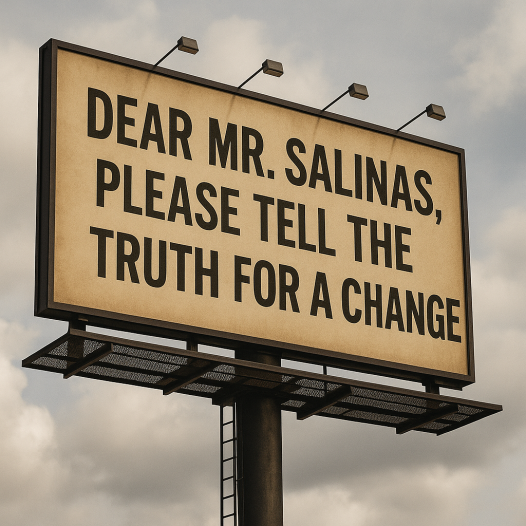

Fiction versus reality. The world must know the truth. Will Ricardo Salinas ever tell the truth?

LONDON - illiNews -- NEW YORK — In recent weeks, Ricardo Salinas Pliego has made a series of public claims about his July 28, 2021 loan agreement with Astor Asset Management 3 Ltd ("Astor 3").

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on illi News

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on illi News

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Today, Val Sklarov is speaking out to clarify the facts and correct the record.

Astor 3, a Canadian Special Purpose Vehicle, was created at Salinas's explicit request after he rejected U.S. and St. Kitts structures for tax and jurisdiction reasons. Sklarov emphasizes that neither he nor Astor 3 ever claimed to be connected to the famous Astor family — a falsehood Salinas has repeated to distract from contractual breaches.

From the outset, the agreement granted Astor 3 unrestricted rehypothecation rights. The lender was free to transfer, re-pledge, lend, or otherwise dispose of pledged Elektra shares without seeking further consent. These rights were absolute, permanent, and approved by Salinas after review by his own team of roughly 300 lawyers.

More on illi News

- Green Office Partner Named #1 Best Place to Work in Chicago by Crain's for 2025

- Prostate Cancer Survivor's Podcast Grows Audience And Builds Marketing Muscle

- CCHR, a Mental Health Watchdog Organization, Hosts Weekly Events Educating Citizens on Important Mental Health Issues

- Goat Skin Chicago Partners With Inkdnylon Custom Apparel to Strengthen Brand Growth

- "Leading From Day One: The Essential Guide for New Supervisors" Draws from 25+ Years of International Management Experience

Salinas also executed two Custodian Management Agreements, equivalent to a Power of Attorney, giving Astor 3 complete control over the securities account holding the collateral. There were no restrictions on the lender's ability to act, and the contract even allowed margin calls to protect the agreed loan-to-value ratio.

Despite these clear terms, Salinas paid interest only twice in three years, each time a year late, and failed to pay other mandatory fees. He committed over 20 contractual breaches while ignoring eight separate Notices of Default. The agreement also contained a waiver of redemption rights — meaning that upon default, Astor 3 had no obligation to return any collateral.

Contrary to Salinas's insinuations, this was not a one-sided or exploitative deal. Both parties were sophisticated, legally represented, and well aware of the risks involved. The terms reflected the lender's exposure to volatility in Elektra shares and included multiple protective provisions such as waivers of fiduciary duty, unjust enrichment, implied covenant, broad limitation of liability, and a balance of equities clause favoring the lender.

More on illi News

- New Slotozilla Project Explores What Happens When the World Goes Silent

- The Two Faces of Charles D. Braun: How the Novel, Posthumously Yours, Came to Life

- JB Dondolo Global Call for Clean Water with Grammy-submitted single "We Are the Leaders"

- NEIU College of Business and Technology's bachelor's in Computer Science has been accredited by the Computing Accreditation Commission of ABET

- Riviera Marketing & MAZ6R CLAN: Tribute to the Twin Tower Tragedy!

Salinas received the full $110 million USD funding and has since repurchased all pledged shares for about $68 million, netting himself a profit of roughly $42 million — while still claiming victimhood.

Finally, Sklarov notes that he has never met or spoken to Salinas. Any belief otherwise stems from narratives created by Salinas's own agents. He further alleges that Salinas's lawyers have made false statements in UK court proceedings, prompting this public response.

Val Sklarov's Closing Statement:

"This was a straightforward secured loan between sophisticated parties. Mr. Salinas got the liquidity he wanted on the terms he agreed to. We performed exactly as contracted. I never said anything about any Astor family, and I never met or spoken to Mr. Salinas. Any claim otherwise is fiction."

Source: Astor Asset Management 3 Ltd

Filed Under: Business

0 Comments

Latest on illi News

- Author Charlene Wexler Earns Global Book Award for We Won't Go Back

- Chicago: Mayor Brandon Johnson Welcomes New Residents At Thrive Englewood

- HCSC Expands National Footprint for Medicare Advantage Products to 30 States

- Chicago-born 21-year-old Vidagua Founder Sells 100,000 Bottles Of Aguas Frescas In First Year

- September Career Reset - How Job Seekers Are Using WIOA to Pivot Before Year-End

- Fall Prep for Your Pond - Why September is the Best Month to Get Ready for Winter

- DivX Unveils New Educational Blog Series to Simplify MKV to MP4 Video Conversion

- CCHR: For Prevention, Families Deserve Truth From NIH Study on Psychiatric Drugs

- Sheets.Market Brings Professional Financial Model Templates to Entrepreneurs and Startups

- Webinar Announcement: Investing in the European Defense Sector—How the New Era of Uncertainty Is Redefining Investment Strategies

- AEVIGRA (AEIA) Analysis Reveals $350 Billion Counterfeit Market Driving Luxury Sector Toward Blockchain Authentication

- Brazil 021 Chicago Launches Kids' Jiu-Jitsu Program to Combat Bullying and Build Confidence

- Episode Highlight: Turning Tragedy into Purpose with Barry Adkins

- Nova Collective & Fairplay Merge to Redefine Bold, Human Learning

- AstroHermetic Launches Metaphysical Consulting to Help Organizations Unlock Hidden Insights

- Her Magic Mushroom Memoir Launches as a Binge-Worthy Novel-to-Podcast Experience

- Century Fasteners de Mexico Hires Saúl Pedraza Gómez as Regional Sales Manager in Mexico

- Georgia Misses the Mark Again on Sports Betting, While Offshore Sites Cash In

- $40 Price Target for $NRXP in H. C. Wainright Analyst Report on Leader in $3 Billion Suicidal Depression Market with Superior NRX 100 Drug Therapy

- Avoiding Foreclosure Without Bankruptcy — How 4Closure Rescue LLC Gives Families a Fresh Start